How much news?

Recently, chengdu research base of giant panda announced that, in order to further protect animal welfare, chengdu research base of giant panda plans to explore a trial animal rest system, and will temporarily try to close the juvenile giant panda villa area on Mondays from December 25, 2023. Giant pandas like to mention "legal holidays", which reflects the public’s love for giant pandas from the side. In 2023, in addition to the giant panda, which animal friends will "go out of the circle"?

Giant pandas also have a "rest day"?

On December 22nd, chengdu research base of giant panda announced that it would temporarily try to close the juvenile giant panda villa area on Mondays from December 25th, 2023 (inclusive). And remind tourists that during the closing period, the area is temporarily closed to tourists, so please plan your tour reasonably.

Image from chengdu research base of giant panda WeChat WeChat official account

It is worth noting that the reason for the announcement that the museum is "closed every Monday" is that in order to further protect animal welfare, it is planned to explore the trial system of animal rotation.

In my impression, this is still a park with ornamental projects, including animal breeding research base and wildlife park. It is the first time to adjust the operating system of the park for the reason of "animal welfare", not just because of "the need of park management".

Different from the controversial topic about being kind to animals in the past, after the announcement of "Rest in Rotation" in chengdu research base of giant panda, the comments of netizens were all praise. Almost no one questioned this "rest in rotation" measure, even if some people would not be able to see the true face of the panda baby or affect their travel itinerary because of the "rest in rotation" closure.

On the one hand, the giant panda has never clashed with the daily life of the public and has a good "reputation"; On the other hand, because giant pandas, as "national treasures", have been making contributions to China’s panda diplomacy and wildlife protection, people may think that they should enjoy corresponding "welfare".

But in theory, other animals, including cattle and horses as means of production, cats and dogs as companions for human beings, pigs and sheep as food, and even those wandering animals, as the lives of people living on the same earth, should also receive corresponding attention.

Read more about "Panda likes to take a rest in rotation", and animals deserve a "legal holiday" | Beijing News column.

How did the giant panda become a "top stream" star?

How many times have you been cured by giant pandas this year? The national treasure panda has always been loved by everyone. In 2023, panda-related topics occupied people’s mobile phone screens for many times-Meng Lan, the "three princes" in Xizhimen, and Hua, the "female stars" in Sichuan … On social networks, the list of star pandas grew stronger and stronger. In April, the return of giant panda Yaya to China in the United States once caused a heated discussion, and the topic of "taking Yaya home together" reached 620 million readings. In Chengdu, Sichuan, giant pandas and flowers became popular on the Internet with their triangular rice balls, and what was even more remarkable was the "summoning technique" of grandpa Tan, a breeder, and a short video platform of "flowers and flowers, fruit depends". A video platform showed that a short video about "pandas understand Sichuan dialect series" reached 1.366 million likes.

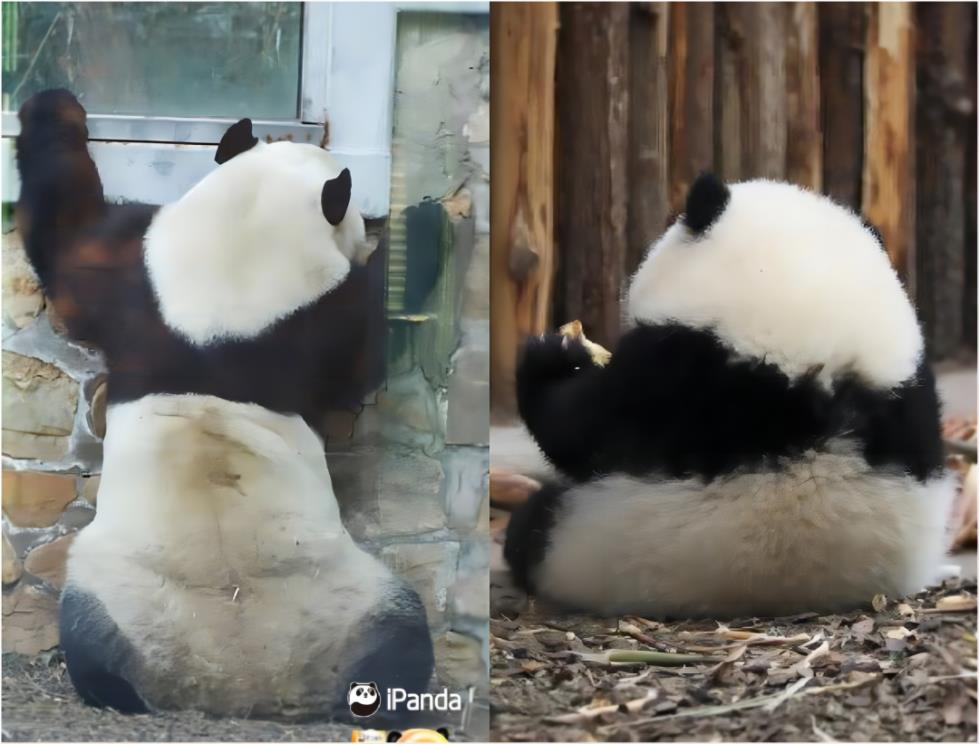

Do you know who is the giant panda and the flower through the back?

The picture is from CCTV.

Family portrait of the giant panda in Beijing Zoo

Image from @ Beijing Daily

Offline, these national treasures are also worthy of the name "top flow". As the "top stream" of Beijing Zoo, there is always a long queue outside the exhibition hall of Meng Lan, a giant panda. According to the Beijing News, during the May 1 ST period, due to the high enthusiasm of tourists, the queue of the "Menglan" sports ground was specially set up in the museum. Visitors who want to see "Menglan" need to wait in line, and some tourists finally see "Menglan" after waiting in line for 4 hours.

According to the cultural and tourism market of Sichuan Province released by the Sichuan Provincial Department of Culture and Tourism in May this year, "online celebrity" giant panda "Huahua" led 264,000 tourists to visit chengdu research base of giant panda, ranking second among the top ten scenic spots in China. During the Chengdu Universiade, the mascot "Rongbao" won people’s attention, including straw hat "Rongbao", peach "Rongbao" and Sichuan Opera "Rongbao" … It is reported that since the release of the mascot "Rongbao", the peripheral products have been continuously innovated and upgraded, and more than 1,000 licensed products have been launched in 18 series. Popular styles are out of stock and restricted, and "Rongbao" has become a "conspicuous bag" in Chengdu this summer.

All kinds of "Rongbao"

The picture is from Xinhua News Agency.

In 2023, what other "out of the circle" animal friends are there?

"Capibala"

Image from IC Photo

The capybara, alias "Capibala", has become synonymous with "emotional stability" because of its mental state of "being trampled on by other animals". As the new favorite of IP in the animal kingdom, "capybara" has been played 1.64 billion times on a short video platform.

"Cat Security" in the Forbidden City

Image from @ Palace Museum

As early as the Ming Dynasty, there was a "Royal Cat Room" in the Forbidden City, in which all the cats kept were serious cats. Since then, 600 years have passed, and these royal cats have been breeding in the Forbidden City and never left. Later, after the establishment of the new China Palace Museum, the descendants of the royal cats were first certified as orthodox by blood, and then they were "collected" again and registered in the book, each with its own name. On December 14, Beijing was snowing heavily, and the Palace Museum sent a group of photos of cats in the snow. The netizen said, "Who is not confused about the cuteness in the snow?"

Hoh Xil Net Red Wolf

Image from People’s Daily

In October this year, some netizens released a video saying that a wild wolf in Hoh Xil, Qinghai was "as fat as two wolves" because it was often fed by drivers and tourists in the past. Not only will it become round, but it will wag its tail at the vehicle and "beg for food". Experts remind that whether in the wild or in the zoo, private feeding will either cause harm to the feeder or the animals to be fed, and may even lead to an epidemic, so it is not advisable to feed.

"Wandering" Macaque

"Walking monkeys" live a life of food and shelter, and "neighbors" include herons and wild boars.

The Beijing News knows the video.

In November, macaques appeared in Chaoyang, Haidian, Tongzhou and other places in Beijing. The Forest Public Security Bureau, together with the Beijing Wildlife Rescue Center and other relevant departments, tried their best to find them. On the afternoon of November 7, they were all found near Dongsishitao in Dongcheng District and Gaobeidian in Chaoyang District, respectively, and have been properly placed in the Beijing Wildlife Rescue Center. Experts remind that wild monkeys are generally more vigilant. If they have not been fed food by humans, they will not approach humans, and even choose to take the initiative to avoid them when they meet humans. But captive monkeys are not afraid of people, they will associate people with food, and even go to places with more people to look for food when they are hungry. If you meet a monkey in the wild, don’t disturb and tease, and keep a proper safe distance. If you encounter monkeys in residential areas, you can contact the wildlife authorities immediately.

The cute bird "Little Fat Choo"

Image from @ CCTV News

Recently, the northern long-tailed tits appeared in Beijing. Wrapped in a piece of silver, the furry tits sometimes sing and sometimes spread their wings and fly, lively and lovely. They often hang upside down from the branches to feed, and then fly to the next tree in a moment, usually without long-distance flight. The northern long-tailed tit belongs to the long-tailed paridae of passeriformes, which is a "three-owned" protected animal with important ecological, scientific and social values, and is relatively common in northeast China and northern Xinjiang. According to the records of Beijing ornithology, the northern long-tailed tits appeared in Beijing in the 1960s, but their numbers were relatively small in the past. This year, compared with previous years, the number is much more and they are in groups, which is rare.

Integrated from Xinhua News Agency, CCTV News, Guangming Daily, Beijing News, Beijing Haidian WeChat WeChat official account, etc.

Editor Ma Haoge

Proofread Li Lijun