Entrepreneurship and innovation flourish, and emerging industries thrive.

— — The fourth in a series of achievements in economic and social development since the 18th CPC National Congress.

Since the 18th National Congress of the Communist Party of China, under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, the whole country has actively adapted to grasp and lead the new normal, firmly established new development concepts, put innovation at the core of the overall national development, thoroughly implemented the innovation-driven development strategy, strengthened the leading role of scientific and technological innovation in all-round innovation, vigorously promoted mass entrepreneurship and innovation, and actively promoted the "Made in China 2025" and "internet plus" action plans. Structural adjustment, transformation and upgrading continue to accelerate, new formats and new models are constantly emerging, new products and services are growing rapidly, emerging industries are growing sturdily, new and old kinetic energy is being accelerated, and the development space is further expanded, which continuously injects new strong impetus into the economy.

I. The momentum of scientific and technological innovation is strong and the level of development is constantly improving.

Since the 18th National Congress of the Communist Party of China, all localities and departments have insisted on giving full play to the leading role of scientific and technological innovation, vigorously promoted the construction of technological innovation centers and cross-regional innovation networks, actively guided the rational gathering and flow of innovative resource elements, and constantly strengthened the dominant position of enterprises in innovation. The scientific and technological innovation environment has been continuously optimized, the innovation ability has been significantly enhanced, and the economic development has been accelerated from factor-driven to innovation-driven mode.

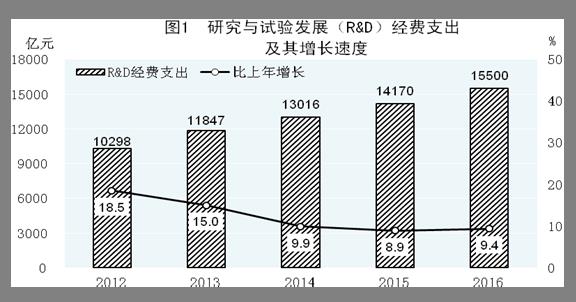

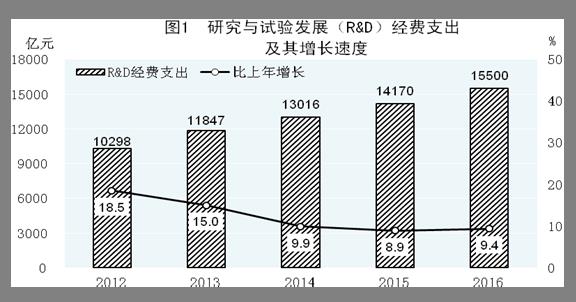

First, the investment in scientific and technological innovation is increasing. The government’s support for scientific and technological innovation has continued to increase, the consciousness of market players in innovation and development has improved significantly, and China’s R&D investment has increased rapidly, and its total scale has ranked among the top in the world. In 2016, China’s research and experimental development (R&D) expenditure reached 1.55 trillion yuan, an increase of 50.5% over 2012, with an average annual increase of 10.8%; The ratio to GDP was 2.08%, 0.17 percentage points higher than that in 2012. Financial investment in science and technology has been increasing. In 2016, the expenditure on science and technology in the national general public budget was 656.8 billion yuan, an increase of 47.5% over 2012, with an average annual increase of 10.2%. The proportion of R&D investment in enterprises has increased significantly. In 2015, the R&D funds of Chinese enterprises were 1,058.9 billion yuan, an increase of 38.9% over 2012, with an average annual increase of 11.6%; The proportion of R&D expenditure in the whole society reached 74.7%, 0.7 percentage points higher than that in 2012. In 2015, the R&D expenditure of industrial enterprises above designated size was 1,001.4 billion yuan, accounting for 0.90% of the main business income, an increase of 0.13 percentage points over 2012. In 2016, 1,163 scientific and technological projects were arranged in 42 key R&D programs, 224 projects were arranged in major national scientific and technological programs, and 41,184 projects were funded by the National Natural Science Foundation. By the end of 2016, 488 state key laboratories and 131 national engineering research centers had been built.There are 194 national engineering laboratories and 1276 national enterprise technology centers.

Second, major scientific and technological innovations have emerged one after another. While increasing investment in science and technology, the introduction and training of high-end talents have continued to increase, and high-tech leading talents and outstanding scientific and technological innovation teams have emerged, forming a large number of landmark scientific and technological achievements. In basic research, quantum anomalous Hall effect, iron-based high-temperature superconductivity, felfermions, dark matter particle detection satellites, heat shock protein 90α Major breakthroughs have been made in research fields such as CIPS stem cells. In terms of strategic high technology, the Shenzhou 11 manned spacecraft and Tiangong-2 space laboratory realized automatic rendezvous and docking, and astronauts traveled in space for 30 days; The Long March 5, a new generation launch vehicle with high thrust, was launched, and the first quantum science experimental satellite "Mozi" and the first global carbon dioxide monitoring scientific experimental satellite were successfully launched; The world’s first 1 billion times/second supercomputer system "Shenwei Taihu Light" with self-developed chips ranks first in the world; The maximum diving depth of Haidou unmanned submersible is 10,767 meters, making China the third country to develop a 10,000-meter unmanned submersible. In terms of major equipment and strategic products, high-speed railways, hydropower equipment, UHV power transmission and transformation, hybrid rice, Earth observation satellites, Beidou navigation and electric vehicles have developed rapidly, and some products and technologies have begun to go global.

Third, the ability of scientific and technological innovation has been steadily improved. The reform of science and technology management system has moved towards systematization and deepening, the overall coordination of science and technology resources has been further strengthened, the market-oriented technological innovation mechanism has been gradually improved, China’s scientific and technological innovation capability has been continuously improved, and the scientific and technological content of economic growth has increased significantly. In 2016, the number of patent applications accepted in China reached 3.465 million, an increase of 68.9% over 2012, of which the number of invention patent applications accepted reached 1.339 million, an increase of 105.1%, ranking first in the world for six consecutive years; The number of patents granted in China reached 1.754 million, an increase of 39.8% over 2012, of which 404,000 were granted invention patents, an increase of 86.2%, and the proportion of invention patents granted was 23.0%, an increase of 5.7 percentage points over 2012. By the end of 2016, there were 1.1 million valid invention patents in China, exceeding 1 million, and the number of invention patents per 10,000 population was 8.0. According to the global innovation index released by the World Intellectual Property Organization, the comprehensive ranking of China’s innovation capability rose from 34th in 2012 to 25th in 2016, ranking first among middle-income economies. The technology trading market is more active. In 2016, the national technology market turnover was 1,140.7 billion yuan, an increase of 77.2% over 2012. The contribution of scientific and technological innovation to economic growth is constantly improving. In 2015, the contribution rate of scientific and technological progress reached 55.3%, an increase of 3.1 percentage points over 2012.

Second, mass entrepreneurship is surging with innovation, and its development vitality is increasingly stimulated.

Since the 18th National Congress of the Communist Party of China, the reform of decentralization, combination of decentralization and management, and optimization of services has been deepened, the protection of intellectual property rights has been significantly strengthened, the market environment of fair competition has been further improved, and the mechanism of personnel training and mobility has been gradually improved, which has effectively stimulated the enthusiasm of social entrepreneurial innovation, the market players have grown rapidly, the employment effect of entrepreneurship has been obvious, the efficiency of resource allocation has been improved, and the market vitality has been continuously enhanced.

First, the entrepreneurial innovation environment is constantly optimized. In recent years, the State Council has cancelled and decentralized more than 600 administrative examination and approval items, exceeding the target of reducing administrative examination and approval items by 1/3 by the current government two years ahead of schedule. The examination and approval of non-administrative license has completely ended; The total number of projects approved at the central level has decreased by 90%; More than 95% of foreign investment projects and more than 98% of overseas investment projects are changed to online filing management; The industrial and commercial registration was changed from "license before license" to "license before license"; Pre-approval has been streamlined by more than 85%. The reform of the commercial system has achieved remarkable results, and the degree of enterprise registration convenience has been continuously improved. The average time for newly established enterprises to complete all registration has been shortened from 26 days before the reform to 14 days. According to the report released by the World Bank, the global ranking of Chinese mainland’s ease of doing business has increased by 18 places since 2013. Venture capital guidance fund for emerging industries, SME development fund and national scientific and technological achievements transformation guidance fund have been set up successively, and the support system for venture capital financing and venture service has been continuously improved. Various types of dual-innovation support platforms have sprung up in large numbers, and mass creation, crowdsourcing, mass support and crowdfunding have developed rapidly. At present, there are more than 4,200 enterprise mass creation spaces and more than 3,000 technology business incubators in China, and more than 400,000 entrepreneurial enterprises and teams have been served, and nearly 1,000 listed companies have been cultivated.

Second, the vitality of entrepreneurial innovation continued to be released. Under the guidance of the government and the promotion of reform, the vitality of social entrepreneurship and innovation has been effectively stimulated, the enthusiasm of all kinds of personnel has been constantly rising, and the newly registered market entities have grown rapidly, with a good development momentum. In 2014-2016, there were more than 44 million newly registered market entities in China [1], and the average daily newly registered market entities exceeded 40,000. Among them, there are 13.62 million newly registered enterprises and 12,000 newly registered enterprises every day, with an average annual growth rate of 30%. Among newly established enterprises, new market players in the service industry grew rapidly. In 2016, there were 4.46 million newly registered service enterprises, an increase of 55.4% over 2014; The proportion of service enterprises in newly registered enterprises reached 80.7%, an increase of 2 percentage points over 2014. Small and micro enterprises are highly active. In 2016, the proportion of newly established small and micro enterprises was 85.8%, and the annual opening rate of newly established small and micro enterprises reached 70.8%. By the end of 2016, there were 87.05 million market players in China, an increase of 25.6% over the end of 2014.

Third, the spillover effect of entrepreneurial innovation is obvious. Mass entrepreneurship and innovation effectively promote employment growth, promote the deepening of supply-side structural reform, promote industrial upgrading and development, and support the stable and positive economy. In 2016, the number of new recruitment positions for start-ups exceeded 2.4 million, accounting for 18.7% of the new recruitment positions. The number of college students and migrant workers returning to their hometowns has increased significantly. In recent years, more than 4.5 million migrant workers have returned to their hometowns to start businesses [2], and the number of college students registered to start businesses in 2016 reached 615,000. In 2016, there were 207.1 million people employed in urban individual economy and private economy, an increase of 56.9% over 2012, with an average annual increase of 11.9%. Entrepreneurial innovation promotes industrial development to the middle and high end. In 2016, the added value of high-tech industries increased by 10.8% over the previous year, and the equipment manufacturing industry increased by 9.5%, both of which were significantly faster than the growth rate of industries above designated size; Equipment manufacturing and high-tech industries accounted for 32.9% and 12.4% of the added value of industrial enterprises above designated size, respectively, up by 4.7 and 3 percentage points compared with 2012.

Third, new industries and new products have grown rapidly and their development potential has been effectively released.

Since the 18th National Congress of the Communist Party of China, all localities and departments have actively promoted the integration of technology and market, innovation and industrial docking, vigorously cultivated emerging industries facing the future, fully implemented Made in China 2025, effectively played the role of the national venture capital guiding fund for emerging industries, highlighted the development highlights of emerging industries, and constantly emerged new products that meet market requirements, optimizing the supply structure and quality.

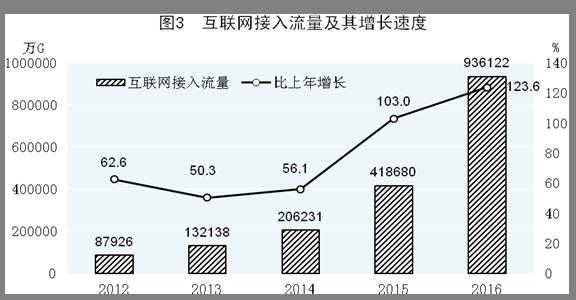

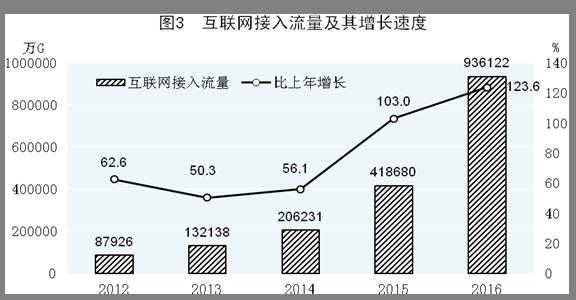

First, the development of emerging industries has begun to take shape. Under the influence of a series of policies and measures to encourage and promote the development of emerging industries, China’s emerging industries have a good momentum of development and their scale has been growing. In 2016, the added value of China’s strategic emerging industries increased by 10.5% year-on-year, which was 4.5 percentage points faster than that of industrial enterprises above designated size. The information industry has risen rapidly. In 2016, the number of Internet broadband access ports reached 690 million, an increase of 1.1 times over 2012; The total number of mobile communication base stations reached 5.59 million [3], an increase of 1.7 times; There are 297.21 million fixed Internet broadband access users, an increase of 122.03 million compared with 2012, with an average annual growth rate of 14.1%. The coverage and service capacity of mobile networks continued to improve. In 2016, there were 940.75 million mobile broadband users, an increase of 707.95 million over 2012, with an average annual growth rate of 41.8%; Mobile Internet access traffic was 9.36 billion g, an increase of 8.48 billion g compared with 2012, with an average annual growth rate of 80.6%; The Internet penetration rate reached 53.2%, an increase of 11.1 percentage points over 2012. The market scale of smart phones, new energy vehicles and industrial robots ranks among the top in the world. According to statistics, in 2016, the total market share of China’s smartphone sales in the world market exceeded 20%; New energy vehicles sold 510,000 vehicles [4], ranking first in the world; The sales volume of industrial robots increased by 31% over the previous year [5], accounting for more than 30% of the global total.

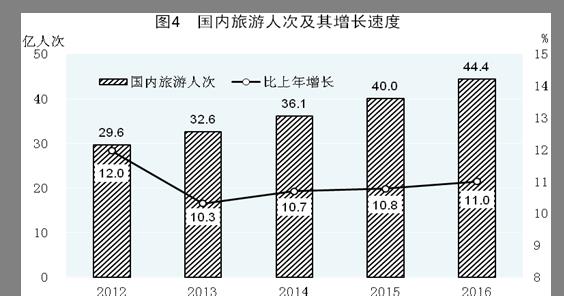

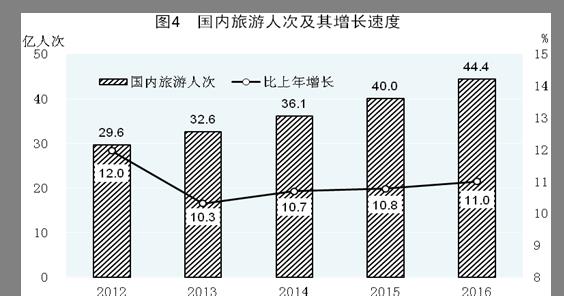

Second, the development of happiness industry is in the ascendant. The upgrading of residents’ consumption structure has promoted the rapid development of happiness industries such as tourism, culture, sports, health, pension, education and training. The scale of domestic tourism and outbound travel market is expanding. In 2016, there were 4.44 billion domestic tourists, an increase of 50.2% over 2012, with an average annual increase of 10.7%; The total domestic tourism expenditure was 3,939 billion yuan, an increase of 73.5% over 2012, with an average annual increase of 14.7%; Residents made 120 million trips abroad, 38.87 million more than in 2012, with an average annual growth rate of 10.1%, ranking first in the world. The cultural and sports industries are thriving. In 2016, the added value of national culture and related industries reached 3,025.4 billion yuan, a nominal increase of 67.4% over 2012, with an average annual nominal increase of 13.7%, which was 5.4 percentage points higher than the nominal growth rate of GDP in the same period; The proportion of GDP was 4.07%, an increase of 0.59 percentage points over 2012. In 2015, the total output of sports industry was 1.7 trillion yuan, with an added value of 549.4 billion yuan, accounting for 0.8% of the GDP in the same period, of which the total output and added value of sports service industry were 571.4 billion yuan and 270.4 billion yuan, accounting for 33.4% and 49.2% respectively. In 2016, cultural and related industrial enterprises above designated size realized operating income of 8,031.4 billion yuan, up by 7.5% over the previous year, and the growth rate was 0.6 percentage points faster than that of the previous year.

Third, new products emerge one after another. Market participants are enthusiastic about developing new products, and supply innovation is constantly increasing. In 2015, the expenditure of industrial enterprises above designated size on developing new products was 1,027.1 billion yuan, an increase of 28.4% over 2012, with an average annual increase of 8.7%. New products with high added value and high technology content are growing rapidly. In 2016, the output of sports multi-purpose passenger cars was 9.14 million, 3.6 times higher than that in 2012, with an average annual growth rate of 46.2%; There were 131.8 billion integrated circuits, an increase of 69.1% over 2012, with an average annual increase of 14.0%. In 2016, the output of industrial robots was 72,000 units, an increase of 30.4% over the previous year; 93.1 million smart TVs, an increase of 11.1%; There were 1.54 billion smartphones, up 9.9%. A large number of strategic new products have emerged in the fields of aerospace, rail transit equipment, high-end CNC machine tools, ships and marine engineering equipment. The first flight of C919 passenger plane was successful, the Long March 5 high-thrust carrier rocket, manned space flight and the world’s first quantum satellite were successfully launched, high-precision CNC gear grinder and other products ranked among the world’s advanced ranks, and China Standard EMU successfully completed the 420km/h intersection test.

Fourth, new formats and new models emerge one after another, and the development momentum continues to increase.

Since the 18th National Congress of the Communist Party of China, various regions and departments have seized the new opportunity of the new round of scientific and technological revolution, implemented the strategy of strengthening the country through the Internet, accelerated the construction of digital China, vigorously promoted the "internet plus" action plan, promoted the integrated development of the Internet and various fields of society, actively created new competitive advantages, and constantly emerged new formats and models, and the penetration of sharing economy continued to increase.

First, the pace of development of new formats has accelerated. Modern information network technology has been widely used, the integration of traditional industries and "internet plus" has been accelerated, the industrial chain, supply chain and value chain have been reshaped, the changes in production, management and marketing modes have been accelerated, and new formats such as e-commerce have sprung up, and online retailing has become a new engine for consumption growth. In 2016, online retail sales reached 5,155.6 billion yuan, up 26.2% over the previous year, of which online retail sales of physical goods reached 4,194.5 billion yuan, up 25.6%. On the day of "Double Eleven" in 2016, the turnover of Alibaba Tmall platform alone exceeded 120 billion yuan, nearly 30 billion yuan higher than that in 2015, an increase of more than 30%, of which the wireless transaction volume accounted for 81.9% of the total transaction volume, covering 235 countries and regions. The popularity of online sales has driven the growth of express delivery and other related industries. In 2016, the express delivery business volume was 31.3 billion pieces, an increase of 25.6 billion pieces compared with 2012, with an average annual growth rate of 53.1%. New formats such as cross-border e-commerce, social e-commerce, smart home, smart transportation, distance education and medical care have emerged rapidly, and digital and intelligent lifestyles have entered ordinary people’s families. At the end of 2016, the number of online education users reached 140 million [6], an increase of 27.5 million over the end of last year, with an annual growth rate of 25.0%; The number of Internet medical users reached 195 million, an increase of 28.0% over the previous year.

Second, the new model has developed rapidly. With the continuous acceleration of technological progress and business model innovation, the process of online and offline integration has accelerated, and new business models such as Internet finance, mobile payment and urban commercial complexes have emerged rapidly. In 2016, banking financial institutions handled a total of 46.2 billion online payment transactions [7], amounting to 2,085 trillion yuan, up 27.0% and 3.3% respectively; There were 280 million telephone payment services, amounting to 17 trillion yuan, the number of transactions decreased by 6.6% year-on-year, and the amount increased by 13.8%; There were 25.7 billion mobile payment services, amounting to 158 trillion yuan, up by 85.8% and 45.6% respectively. Non-bank payment institutions have accumulated 163.9 billion online payment services, amounting to 99 trillion yuan, up 99.5% and 100.7% respectively. At the end of 2016, the number of online payment users in China reached 475 million, an increase of 254 million compared with 2012, with an average annual growth rate of 21.1%. The proportion of Chinese netizens using online payment reached 64.9%, an increase of 25.8 percentage points over 2012. Urban commercial complexes have developed rapidly. By the end of 2015, there were 1088 commercial complexes in China, with a leasable area of 75.2 million square meters; In 2015, the annual passenger flow was 7.37 billion, an increase of 30.1% over the previous year, and the average daily passenger flow was 20.19 million. The annual sales of merchants in commercial complexes reached 583.3 billion yuan, an increase of 22.5% over the previous year.

The third is the extensive penetration of the sharing economy. The sharing economy, such as online booking carpooling, house sharing and car rental, has developed rapidly and penetrated into all fields of social life, creating new economic value and social benefits. According to the estimation of relevant institutions, in 2016, the transaction volume of China’s sharing economy market was about 3.5 trillion yuan [8], an increase of 103% over the previous year, of which knowledge and skills sharing increased by 205%, housing and accommodation sharing increased by 131%, and transportation increased by 104%. The scale of sharing economic financing is about 171 billion yuan, an increase of 130%; More than 600 million people participated in sharing economic activities. The number of online car rental users has increased rapidly. At the end of 2016, the number of online taxi booking users reached 225 million, an increase of 66.13 million compared with the first half of 2016, and the proportion of online taxi booking users among netizens was 30.7%; The number of users booking special cars online was 168 million, an increase of 46.16 million over the first half of 2016, with a growth rate of 37.9%. Bike-sharing’s rapid rise. According to the estimation of National Information Center, the number of registered users in bike-sharing at the end of 2016 was about 2 million, and the daily order volume exceeded one million.

On the whole, all localities and departments thoroughly implement the decision-making arrangements of the CPC Central Committee and the State Council, insist that innovation is the first driving force for development, constantly optimize government services, vigorously improve support policies, actively adjust supervision methods, strive to strengthen support and guarantee, pay attention to giving play to the role of market mechanism, support and guide the development and growth of new industries, new formats and new models, effectively promote the vigorous growth of new kinetic energy, and inject new impetus into sustained and healthy economic development. However, we should also see that China’s economy is currently at a critical stage of transformation and development, facing multiple difficulties such as prominent structural contradictions and weakened traditional growth momentum. To break through the bottleneck constraints faced by traditional development methods, we must adhere to the innovation-driven development strategy and further stimulate social innovation vitality and creative potential. In the next stage, we should further deepen the supply-side structural reform, focus on strengthening reform and innovation, enhance the development momentum through reform, plant development advantages through innovation, promote mass entrepreneurship and innovation, accelerate the cultivation and expansion of new kinetic energy, promote the economy to maintain medium-and high-speed growth, move towards the middle and high-end level, and keep moving forward towards the Chinese dream of building a well-off society in an all-round way, building a socialist modern country and the great rejuvenation of the Chinese nation!

Note:

[1] State Administration for Industry and Commerce data.

[2] Data calculated by the Ministry of Agriculture.

[3] Data of Ministry of Industry and Information Technology.

[4] Data of Association of Automobile Manufacturers.

[5] the International Federation of Robotics data.

[6] Statistical Report on the Development of Internet in China by China Internet Network Information Center.

[7] General Situation of Payment System Operation in 2016 by China People’s Bank.

[8] China Sharing Economic Development Report 2017 by National Information Center.