Wen | Buer Research Institute Yi Xin Zi Qing

Following the price reduction of Tesla at the beginning of the year, in August this year, new energy vehicles once again set off a new wave of price reduction. Brand officials, such as Zero Run and Weilai, announced the price reduction, and the ideal was to "reduce the price in disguise" by releasing new cars.

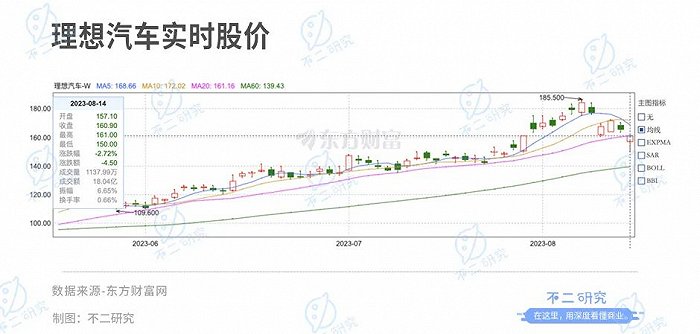

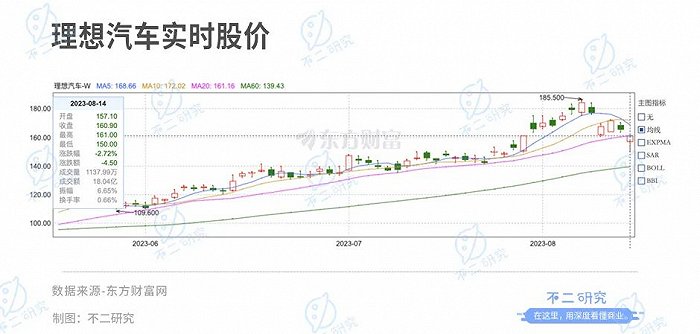

On August 8th, LI (02015.HK) announced the second quarterly report of 2023. Although the net profit of the second quarter increased, its share price showed the opposite trend.

On the day of the financial report, its US stock price closed down by 8.62%; The next day (August 9), Hong Kong stocks closed down 5.52%.

As of August 14th, LI closed at HK$ 160.90 per share, corresponding to a market value of HK$ 335.4 billion (about RMB 311.1 billion).

According to the latest data released by Ideal, its delivery volume in the second quarter reached 86,533 vehicles, up 201.6% year-on-year and 65% quarter-on-quarter. In July, the delivery volume was 34,134 vehicles, up 227.5% year-on-year and only 4.7% quarter-on-quarter.

According to the announcement of LI, it is estimated that the delivery volume in the third quarter is only 100,000-103,000, equivalent to 33,000-34,500 vehicles per month. Based on this data, it is speculated that the growth of ideal monthly delivery volume may stagnate.

According to its second quarterly report, "Buer Research" found that in the second quarter of this year, LI’s revenue was 28.65 billion yuan, a year-on-year increase of 228.1%; The net profit was 2.31 billion yuan, turning losses into profits year-on-year, up 147.4% from the previous month.

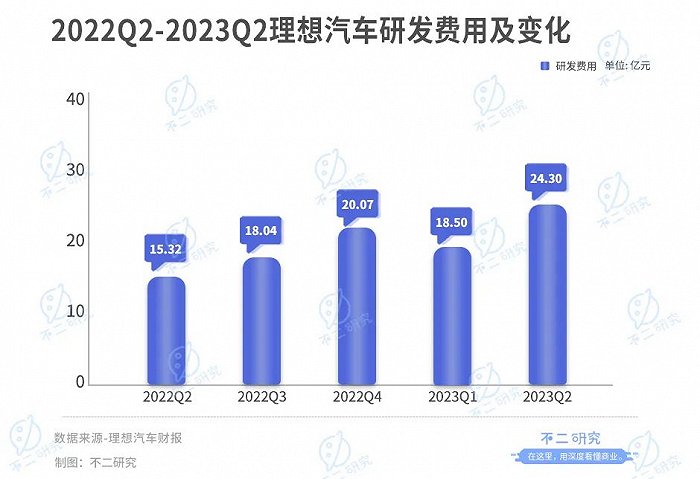

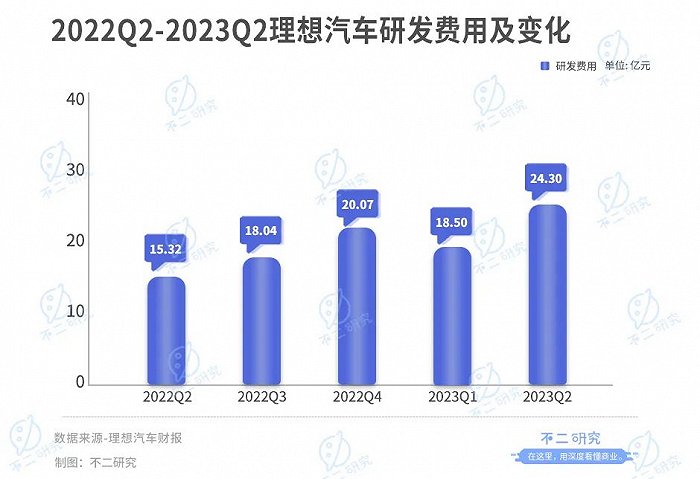

In the second quarterly report, the ideal revenue doubled, but the strategy of re-marketing may continue. The R&D expenditure in the ideal second quarter was 2.43 billion yuan, up 58.4% year-on-year and 31% quarter-on-quarter. Sales, general and management expenses were 2.32 billion yuan, up 74.3% year-on-year and 40.4% quarter-on-quarter.

Source: official website, LI

At present, LI’s production capacity is limited to 8,000 vehicles per week, and the production capacity of parts suppliers has fallen into a bottleneck, which is also a challenge it faces in the second half of the year.

According to the financial report meeting in the second quarter, due to the development of economic situation and the upgrading of enterprise organization matrix at the beginning of the year, it is ideal to lower the planned annual sales target of 360,000 vehicles to 300,000 vehicles.

Today, the new energy vehicle has entered the second half, and the industry volume has been intensified; Although LI turned losses into profits year-on-year, how long can the story of its profitability be sustained and increased?

In March of this year, the new forces of building cars suffered a double crit.

The first crit comes from the continuous price reduction war of peer TSLA, and the second crit is the government-enterprise subsidy jointly initiated by Hubei Dongfeng. The fuel vehicle market is "chaotic", which makes new energy vehicles suffer crit.

As one of the Three Musketeers, a new force in car-making, LI has previously published the 2022 annual report and the first quarterly report in 2023. Although the revenue in 2022 has achieved substantial growth, it is still at a loss.

According to its financial report, "Buer Research" found that in 2022, LI’s revenue was 45.29 billion yuan, a year-on-year increase of 67.7%; In the same period, its net loss was 2.03 billion yuan, up 531.42% year-on-year, making it the most serious year since the listing of US stocks in 2020.

Among them, the ideal automobile sales revenue in 2022 is 44.106 billion yuan, accounting for 97.39% of the total revenue. According to "Buer Research", due to the increase in R&D investment and rising operating costs in 2022, the automobile sales revenue failed to catch up, which led to the further expansion of LI’s net loss.

Under the new energy automobile track, it still takes time to accumulate and reserve funds to transform R&D investment into automobile production capacity.

Although the capital reserve has been expanded after the dual listing, more and more car-making competitors and intensified competition in sub-sectors seem to be shortening the ideal "new" time window.

01 landing in Normandy

In 2015, after leaving office in car home, Li wanted to start a business again, aiming at the field of new energy vehicles. At that time, Tesla was in the limelight, and many Tesla "fans" emerged in China.

Source: LI founder-Li Xiang-LI Guan Wei

Since then, Li Xiang’s brand ideal of new energy vehicles has stood out, and he, together with Weilai Automobile and Xpeng Motors, has been called "Three Musketeers".

In 2019, when the ideal first car, Li ONE, was officially launched, Li Xiang said frankly, "I have been in business for 20 years, and today is my most nervous day, and it is also the Normandy landing day of the company".

In July 2020, above the new energy outlet, it was ideal to land on Nasdaq in the United States, and the IPO was priced at $11.5 per share, with the highest increase of more than 50% on the first day of opening.

On August 12, 2021, LI landed on the Hong Kong Stock Exchange, becoming the second new car-making force to achieve dual listing in Hong Kong stocks after Xpeng Motors.

Although the new energy outlet is still there, the competition of the Three Musketeers, a new force to build cars, is intensifying. Compared with the increasingly full product matrix of Weilai and Tucki, the outside world is quite worried about the ideal car-making pace: the 2020 Li ONE that landed in Normandy has been sold for nearly three years, and the ideal finally got the new 2021 Li ONE.

Source: official website, LI

According to the ideal quarterly report in 2023, its total revenue in the first quarter was 18.79 billion yuan, up 96.5% year-on-year and 6.4% quarter-on-quarter. In the same period, the net profit was 934 million yuan, turning losses into profits. In addition, the ideal annual gross profit margin in the first quarter of 2023 is still declining.

According to "Buer Research", the ideal main revenue source is vehicle sales, and its vehicle sales revenue in the first quarter of 2023 was 18.33 billion yuan, accounting for 97.55% of the total revenue.

The increase in sales revenue in LI is mainly due to the increase in delivery volume in the first quarter and the increase in the average selling price of ideal L series models. In addition, the revenue and delivery have been greatly improved, which has also enabled LI to turn losses into profits.

Entrepreneurship means choosing the path of extended-range technology and relying on an extended-range electric vehicle to conquer the world. The ideal can be described as a different kind among the three musketeers, a new force in building cars. However, the increasingly strict policy supervision is like the sword of Damocles hanging overhead, and it is ideal to make up for the autopilot technology.

Li Xiang once said frankly, "In terms of autonomous driving, compared with Tesla and Tucki, we have to make up lessons." According to the plan, this year’s ideal research and development is continuously invested; In the first quarter, its R&D expenditure was 1.85 billion yuan, up 34.8% year-on-year; In the second quarter, its R&D expenditure was 2.43 billion yuan, a year-on-year increase of 58.4%.

When the market structure of the new force of car-making is initially determined, the competition of new energy vehicles has entered the second half: the sales and mass production targets of 280,000-300,000 vehicles, and the fierce competition of autonomous driving technology.

As a supporter of the "10,000-hour Law", Li Xiang once wrote in Weibo, "I have trained more than 60,000 hours in the automobile industry since 2004, and I am more confident in my major".

It seems that the capital market that votes with its feet is not satisfied with Li Xiang’s "10,000-hour law".

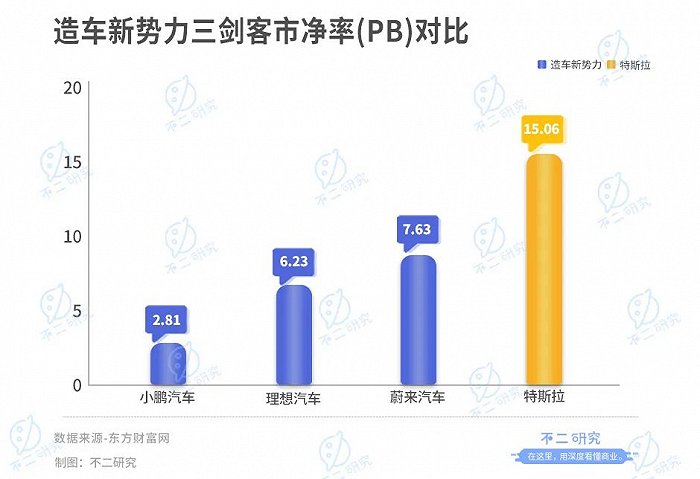

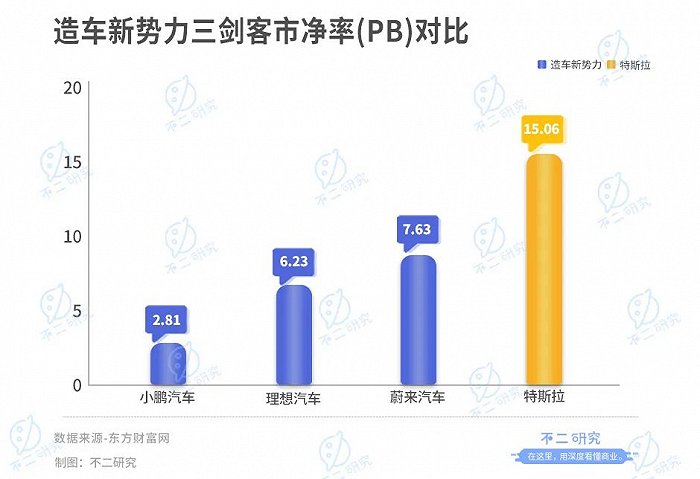

By comparing the PE value (P/E ratio) and the PB value (P/B ratio) of the Three Musketeers, a new car-making force, it was found that by the close of the US stock market on August 12th, EDT, except LI, the PE values of the new car-making force were all negative, with the PB values of Tucki 2.81, Ideal 6.23 and Weilai 7.63 in turn, while the PB value of Tesla was 15.06.

Among the three musketeers, the ideal PB value ranks second, which is about 1/10 of Tesla PB value. The higher the PB value, the higher the valuation of enterprises in the capital market.

As of August 12th, EST, the US stock market closed, with an ideal market value of $42.18 billion, while Tesla’s market value has passed the $700 billion mark.

02 on the new speed.

On May 25th, 2021, Ideality released the 2021 Li ONE in Beijing, which was different from the enthusiastic conference site. The capital market reacted coldly and fell immediately after the opening of the day. Only one day later, it is ideal to announce the financial report for the first quarter of 2021, from profit to loss.

"Li Xiang, you owe an explanation to the owner who picked up the car in April and May." After the release of the 2021 Li ONE, Li Xiang’s Weibo was overwhelmed by the owner’s doubts.

According to the ideal plan, after the production and sales of the 2021 Li ONE model begin, the production of the 2020 model will stop. The car owner who just bought the old model of Li ONE soon felt that he had been "cleared of inventory" by routine. Although it is ideal to provide four paid upgrade schemes for old car owners, it still cannot satisfy the skeptics.

In August of the same year, a similar scene was once again staged in the ideal riders group: the prospectus revealed that the ideal will launch a new full-size SUV in 2022, and compared with the existing products, the size, hardware and intelligent configuration have been improved in many aspects.

Source: LI Guanwei

To some extent, the rapid iteration of new energy vehicles is accelerating the depreciation of the value of the previous generation models. Anxiety, confrontation and other emotions spread between riders waiting for a full-size new car and owners who have already picked up the car.

According to "Buer Research", the innovative technology of new energy vehicles is both a spear and a shield. Compared with traditional cars, the product cycle of new energy vehicles is shorter; How to balance customer perception and product iteration has also become an ideal test.

However, the other side of the coin is the risk brought by the thin product line, and any fluctuation in Li ONE may trigger a chain reaction.

In order to change this situation, it is ideal to replace Li ONE with L8 and L9 from the second half of 2022.

In the fourth quarter of 2022, the ideal delivery volume was 46,319 vehicles, a year-on-year increase of 31.5%; In the same period, Weilai and Tucki delivered 40,052 vehicles and 22,204 vehicles respectively, both of which increased year-on-year.

By the end of 2022, it is ideal to deliver 133,246 vehicles throughout the year, up 47.2% year-on-year; Although it did not reach the expected goal of LI, it was slightly ahead of Weilai Automobile’s 122,486 vehicles and Xpeng Motors’s 120,757 vehicles in terms of the number of deliveries in 2022.

By the end of January this year, LI’s monthly sales even exceeded the combined monthly sales of Weilai Automobile and Xpeng Motors.

In the first quarter of this year, the ideal delivery volume was 52,584 vehicles, a year-on-year increase of 65.8%; The deliveries of Weilai and Tucki in the same period were 31,041 and 18,230 respectively.

The outbreak of black swan is only a small probability event. If compared with the same industry, to some extent, the large data fluctuation of ideal sales revenue is related to its single product structure.

In the view of "Buer Research", in the early stage of starting a business, the 2020 Li ONE solo combat can unite all the superior resources; However, due to the lack of product matrix, ideal is losing its position in the price range, and it is easy to fall into the situation of weak subsequent growth.

Expanding the product matrix is imminent. On August 3 this year, it officially launched the ideal L9 Pro. According to the ideal plan, it is expected to launch the first pure electric vehicle MEGA; by the end of 2023. And in 2024, four new cars will be released, including an extended-range SUV and three pure electric models.

Source: official website, LI

It is not easy to "upgrade" new energy vehicles, and R&D investment is similar to "arms race"; Only from the number of patents and invention patents in 2020, the ideal is relatively backward.

Intelligent driving is the focus of LI’s current layout. This year, the ideal plan is to land the "NOA" function in 100 cities.

At present, LI has successfully opened the urban NOA internal test in Shanghai and Beijing, and completed the first test drive of urban NOA and commuter NOA in Beijing. It is expected that in the third quarter, Ideal will also open the commuting NOA function to "early bird users".

In the view of "Buer Research", when the potential of new energy vehicle track is highlighted, attracting many car-making forces to enter the market, the competition in market segments will become more intense.

Regardless of the technical path, ideally, the time window of the new product matrix is limited, and it is urgent to find a balance between iterative novelty and customer perception.

03 Flag of Li Xiang

In February 2021, Li Xiang said in an internal letter that by 2025, it is ideal to win 20% of the market share and become the first intelligent electric vehicle enterprise in China; In 2030, it will go further and become the first intelligent electric vehicle enterprise in the world.

In the second quarter of this year, Li Xiang set a new Flag: the ideal total sales this year will exceed the target at the beginning of the year by 10%-20%. The ideal target at the beginning of the year is annual sales of 306,000 vehicles, and the adjusted sales volume is expected to be 336,000-366,000 vehicles.

According to the latest data released by Ideal, its delivery volume in the second quarter reached 86,533 vehicles, up 201.6% year-on-year and 65% quarter-on-quarter. And delivered 34,134 vehicles in July.

In terms of production capacity closely related to the delivery volume, the "Buer Research" found that the annual production capacity of the ideal Changzhou factory in 2020 will be about 100,000 vehicles, and the annual production capacity of the factory will increase to 200,000 vehicles after upgrading.

After the release of Q3 financial report in 2022, Shen Yanan, the ideal co-founder and president, announced his resignation. He helped LI choose to build his own factory in Changzhou. This adjustment is regarded as a large-scale change since the establishment of Ideal.

At the ideal second-quarter financial report meeting on August 8, Li Xiang said that at present, due to the influence of supplier supply, the production capacity is in a bottleneck.

Earlier, there were media reports that Ideality was contacting Beijing Hyundai and hoped to receive its first factory that had stopped production. At present, the Beijing base is expected to be officially put into production at the end of this year. In addition, it is reported that the production plan of the ideal third factory, Chongqing production base, has stopped.

According to "Buer Research", if we want to achieve production and sales of 1.6 million vehicles in 2025, we need a strong production capacity reserve. The only Changzhou factory and Beijing factory may not have enough production capacity to carry their delivery demand, so the construction of new factories is imminent.

Previously, compared with the other two new car-making forces, the ideal offline layout was not dominant and is currently accelerating.

By June 30, 2023, LI had operated 331 retail stores covering 127 cities. In addition, LI operates 323 after-sales maintenance centers and authorized car body and painting centers in 223 cities.

When Internet companies such as Baidu and Xiaomi went off to build cars one after another, the war of new energy vehicles intensified. Regarding the cross-border showstopper, Li wants to speak frankly about the car, saying that the car sales can’t be faked, and the final development depends on the final product.

Although LI is speeding up its running, will Li Xiang’s Flag fall down under many skinny realities?

"Ideal" meets the cold reality

Although the ideal delivery volume since 2023 has been leading the new domestic car-making forces, LI still considers 2023 as "Alexander". In particular, the head car companies headed by Tesla started a price war, which caught the industry off guard.

However, as a "hardware for traffic portal, software for charging service", Tesla model seems to bring new imagination space for new energy vehicles.

When the income of Tucki XPILOT software and Weilai NIOPILOT software increased, Li Xiang declared: "The new Li ONE autopilot is standard, and the future ideal will not charge for autopilot".

"With the development of smart cars, there will be more and more usage scenarios for users and more and more business models." Li wants to put his hopes on another possibility of business model innovation, but it needs to be built on the basis of ownership.

Che Gewana once said, let’s be loyal to our ideals and face reality. On the increasingly crowded track, Li wants to be loyal to his ideals, but he also needs to face reality: the day after tomorrow of new energy vehicles is beautiful, and today is very difficult. The key is whether he can survive tomorrow.

Some references in this article:

1. LI, Sorry for the Old Car Owner, Sina Technology.

2. Li Xiang with Ideal, Taber.com.

3. "The listing price of LI and Hong Kong is HK$ 118, which is 21.3% lower than the suggested subscription price", Caixin.com.

5. "LI’s second-quarter earnings revenue increased significantly, and the decline in US stocks reflected investors’ concerns", interface news.

6. Ideal sells crazy, but it can’t relax its vigilance. Connect sight.