The share price of zero-run cars has risen against the trend: since the beginning of the year, it has raised funds frequently, and its future development prospects are optimistic.

It is reported that Zero Car (09863) rose more than 5% in late trading. As of the close of 26th, the share price of Zero Car rose 5.31% to HK$ 22.8, with a turnover of HK$ 120 million.

In the news, Zero Run delivered 18,618 vehicles in December, which was +119%/+1% compared with the previous month. In 2023, a total of 144,155 units were delivered, and more than 300,000 units have been delivered since its establishment. In addition, the zero run C10 was pre-sold on January 10th. According to the analysis, 2025 will be the year of zero-running cars, and it is expected that 5 or 6 brand-new products will be launched.

In the same period, it was learned that the latest sales data of new power brands in China market was released, and the performance of zero-running cars attracted people’s attention. As of the 21st of this month, the cumulative sales volume of zero-run cars in the first three weeks of this month has reached 0.81 million units, which is in the forefront of the sales volume of the new power camp. This means that the sales volume of zero-run cars will soon exceed the 10,000-unit mark this month, which also indicates the strong start of the brand’s sales volume in 2024, and the strong sales volume will also boost the stock price of zero-run cars.

Not only that, in the latest sales ranking of new power brands, the performance of zero-running cars is better than that of Weilai Automobile (06,600) and Xpeng Motors (04,600), showing strong market competitiveness, and it is also ahead of many competitive brands such as Krypton, Tengshi, Lantu and Zhiji. In the popular new energy vehicle market, the zero-run vehicle has won the recognition and love of more and more consumers with its advanced intelligent electric technology, the ultimate price-to-price ratio advantage and the precise layout of pure electricity and extended-range dual power. The share price of the zero-run vehicle also ushered in a change and stopped falling against the trend.

It is worth noting that since the second half of 2023, zero-run cars have raised funds frequently. Among them, in October 2023, Stellantis Group, the parent company of Citroen, invested about 1.5 billion euros (about 12.36 billion Hong Kong dollars) to acquire about 20% equity of zero-run cars. In January, 2024, Zero Run Auto received 600 million financing from Jinhua Industrial Fund and Wuyi County Jintou, and the subscription premium was nearly 70%. As the news came out, the share price of zero-run cars also rose.

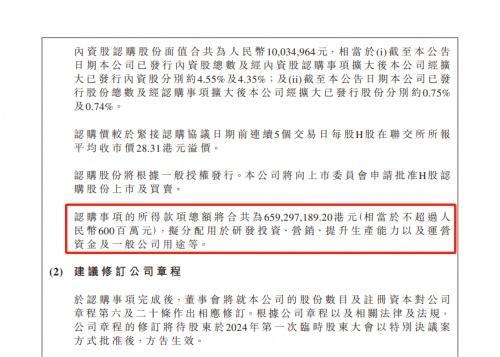

Prior to this, the share price of zero-run cars fluctuated. However, after the announcement of the financing news, the share price of the zero-run car showed an upward trend. It is reported that Jinhua Industrial Fund and Wuyi County Jintou will invest HK$ 659 million in Zero Car by subscribing for H shares and domestic shares. These funds will be mainly used for R&D investment, marketing, improving production capacity, working capital and general corporate purposes.

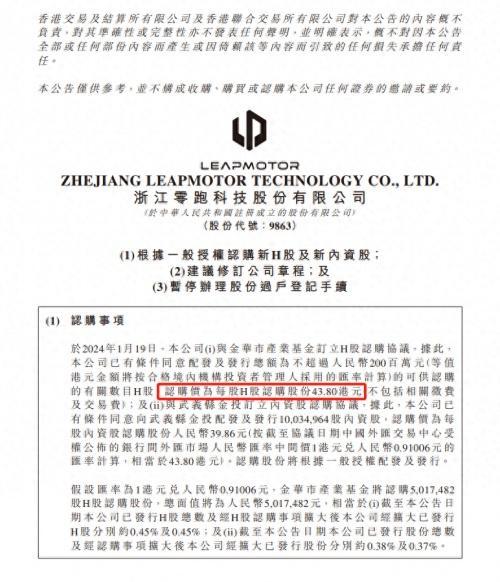

According to the data, as of the close of January 19, the share price of Zero Run Automobile was HK$ 25.8 per share. It is clearly stated in the announcement that the subscription price of this H share is HK$ 43.8 per share, which is a substantial premium of nearly 70% compared with the closing price of the previous day. This news had a positive impact on the share price of Zero Run Automobile, which continued to rise in the transaction after the subscription agreement was announced.

Specifically, Zero Run Auto and Jinhua Industrial Fund reached an H-share subscription agreement. According to the agreement, Jinhua Industrial Fund will subscribe for H shares of no more than 200 million yuan. After the subscription is completed, the public shareholding of Zero Run Automobile will be about 51.55%. As for the subscription price, Zero Run Automobile said that the subscription price of H shares of Zero Run Automobile was higher than the average closing price of HK$ 28.31 in the five trading days before the signing of the agreement. Based on the closing price of HK$ 25.8 on January 19th, the premium of this subscription is nearly 70%. This news has had a positive impact on the share price of zero-run cars, and investors are optimistic about the future development prospects of zero-run cars.

At the same time, Zero Car also signed a subscription agreement for domestic shares with Wuyi County Jintou. According to the agreement, Wuyi County Jintou will subscribe for 10.035 million domestic shares. After the subscription is completed, the public shareholding of the zero-run car will further increase. For the subscription price, the announcement did not disclose more details. However, it is foreseeable that as the company gets more strategic investment and financial support, the share price of zero-run cars is expected to continue to rise.

Generally speaking, the success of the financing of Zero Run Auto not only brought a lot of financial support to the company, but also enhanced the company’s popularity and brand value. With the continuous development of the company’s business and the improvement of technical strength, investors are optimistic about the future development prospects of zero-run cars.

Therefore, it can be predicted that the possibility that the share price of zero-run cars will continue to rise in the future is not small, and behind this, the new high delivery volume of zero-run cars and the optimistic capital are indispensable.