In the first four months, the national general public budget revenue increased by 11.9%.

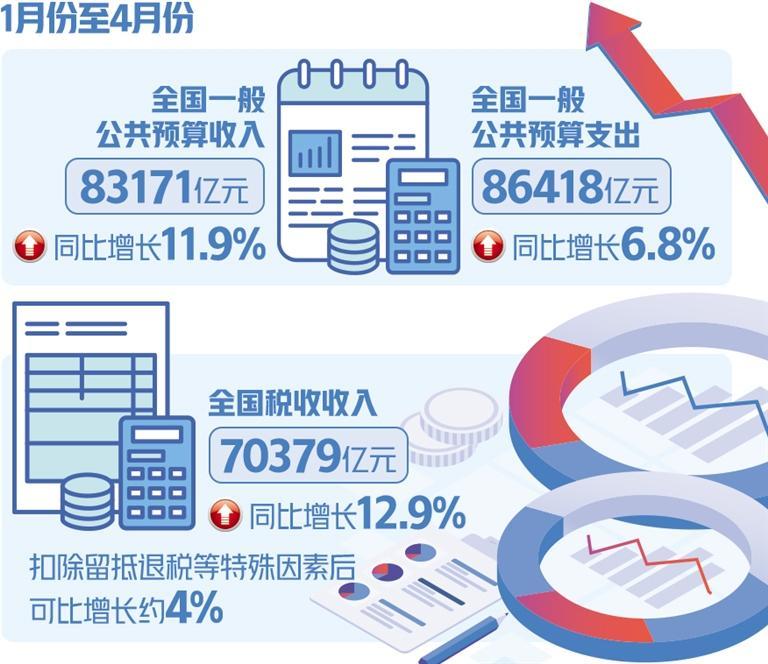

A few days ago, the statistics released by the Ministry of Finance showed that from January to April, the national general public budget revenue was 8,317.1 billion yuan, up 11.9% year-on-year; General public budget expenditure was 8,641.8 billion yuan, a year-on-year increase of 6.8%. Overall, fiscal revenue continued to rise steadily, and fiscal expenditure maintained a high intensity. Experts said that the fiscal revenue and expenditure structure was further optimized and balanced in the first four months, reflecting that fiscal sustainability has improved with the steady recovery of the economy.

It is reported that in the first four months, the national general public budget revenue increased by 11.9% year-on-year, which was not only driven by economic recovery growth, but also affected by some special factors. For example, part of the income at the end of 2021 was put into storage at the beginning of last year, raising the base and lowering the income growth. Last year, small and medium-sized enterprises in the manufacturing industry deferred taxes and some taxes were put into storage at the wrong time this year, which boosted the income growth this year. In addition, a large-scale tax refund policy was implemented in April last year, and it returned to normal this year. The tax refund amount was greatly reduced year-on-year, which directly increased the income growth in April to 70%, which correspondingly increased the cumulative income growth from January to April. After deducting the above-mentioned special factors, from January to April, the national general public budget revenue increased by about 4% on a comparable basis, and the comparable growth rate increased by 1 percentage point compared with the first quarter, continuing the steady recovery trend.

General public budget revenue consists of tax revenue and non-tax revenue. From the perspective of tax revenue, from January to April, the national tax revenue totaled 7,037.9 billion yuan, up 12.9% year-on-year, and increased by about 4% after deducting special factors such as tax rebates.

Statistics show that from January to April, the domestic value-added tax increased by 58%, and increased by about 10% after deducting the tax rebate factor, which was mainly driven by factors such as economic recovery growth and the slow tax payment of small and medium-sized enterprises in manufacturing last year. Domestic consumption tax decreased by 17.9%, and value-added tax and consumption tax on imported goods decreased by 12%, mainly due to the high base in the same period last year. In addition, corporate income tax increased by 3.7% year-on-year.

The real estate market is still gradually recovering, with deed tax increasing by 6.3%, which has rebounded for three consecutive months, mainly driven by factors such as narrowing the decline of land transfer income and the recovery of second-hand housing market in some key cities; Property tax increased by 20.5%, and urban land use tax increased by 11.5%, mainly because the income in some areas was put into storage in advance at the wrong time; Farmland occupation tax decreased by 8.8%, and land value-added tax decreased by 15.2%.

Bai Yanfeng, a professor at the School of Finance and Taxation of the Central University of Finance and Economics, believes that from January to April, the national general public budget revenue and tax revenue achieved double-digit growth, even after deducting incomparable factors such as tax rebate, it also achieved positive growth, especially the growth rate of the first tax value-added tax after deducting the tax rebate factor still reached about 10%, and the income tax of the second tax enterprise also achieved positive growth. "These indicators all show that China’s national economy is fully recovering and getting better."

"Tax indicators that mainly reflect the status of business entities, such as value-added tax and corporate income tax, show a year-on-year growth trend, reflecting China’s strong economic resilience, great potential and full vitality. The proactive fiscal policy will further release the potential of optimizing the economic structure, continue to improve the effectiveness and accuracy of the policy, and promote the consolidation of the economic recovery momentum. " Li Xuhong, director of the Institute of Finance and Taxation Policy and Application of Beijing National Accounting Institute, said.

From the perspective of fiscal expenditure, financial departments at all levels strengthen the overall planning of financial resources, maintain the necessary expenditure intensity, and increase investment in weak links and key areas of economic and social development. Statistics show that from January to April, the national general public budget expenditure increased by 6.8% year-on-year. Key expenditures such as basic livelihood, rural revitalization, major regional strategies, education, and scientific and technological research have been effectively guaranteed. Among them, social security and employment expenditure increased by 10.3%; Education expenditure increased by 6.9%; Health expenditure increased by 8.7%; Urban and rural community expenditure increased by 3.1%; Expenditure on agriculture, forestry and water increased by 8%; Expenditure on science and technology increased by 9%; Expenditure on housing security increased by 8.9%.

Li Xuhong analyzed that the implementation of fiscal expenditure was strengthened in the first four months, especially in the fields of people’s livelihood and science and technology. "In the future, we should further optimize the structure of fiscal expenditure and give full play to fiscal funds ‘ Four or two thousand catties ’ The role of effectively promoting the expansion of investment in the whole society and promoting the recovery and growth of consumption. "

Special debt plays an important role in promoting the expansion of effective investment and maintaining stable economic operation. Statistics show that from January to April, 1,857.5 billion yuan of local government bonds were issued for project construction, including 330.3 billion yuan of general bonds, which were mainly used for the construction of non-profit public welfare projects such as rural revitalization, pollution prevention and control, and reinforcement of small reservoirs. The special bonds amounted to 1,527.2 billion yuan, which were mainly used for municipal construction and industrial park infrastructure, social undertakings, transportation infrastructure, affordable housing projects, agriculture, forestry and water conservancy and other key areas identified by the CPC Central Committee and the State Council, and promoted the construction and implementation of a large number of projects that benefited people’s livelihood, supplemented shortcomings and strong and weak items.

The relevant person in charge of the Ministry of Finance said that the next step will be to work with relevant departments to guide local governments to continue to do a good job in the reserve of special bond projects in accordance with the key areas determined by the CPC Central Committee and the State Council, continuously improve the quality of reserve projects, and give full play to the fund efficiency of special bonds.