2021The main objective is to complete the annual investment in transportation infrastructure buildings75 billion yuan or more; 240 kilometers of new expressways; 300 kilometers of first-class highways; 3,000 kilometers of rural highways; civil aviation passenger throughput 16 million, port container throughput 2 million TEU.

focusDo the following8 areas of work:

(1) Accelerate the start and take the first step in building a strong transportation province

The first is to improve the transportation planning system.Effectively connect the layout of the national comprehensive three-dimensional transportation network, overall plan the provincial comprehensive transportation network and hub system, and complete the preparation of the comprehensive three-dimensional transportation network planning outline in Anhui ProvinceProvincial national economic and social development"Fourteenth Five-Year Plan"planOutline and country"Fourteenth Five-Year Plan"Modern comprehensive transportation system development plan, the introduction of the province’s transportation"Fourteenth Five-Year Plan"Development planning. Complete the preparation of land and spatial planning for transportation infrastructure, and promote the coordination of transportation facility planning and construction with ecological protection red lines and natural protected areas. Issue and implement the highway network revision plan. Form a strong transportation province"Fourteenth Five-Year Plan"And medium and long-term support for the planning system.

two isAccelerate the construction of a transportation power pilot.Launched a pilot implementation plan for building a transportation powerhouse in Anhui Province.Refine the tasks of the pilot project and concentrate on making breakthroughs first. Promote the integrated development of transportation and tourism in southern Anhui, focus on building highways such as Huangqian and Wuhuang, and implement Anhui, Zhejiang and other expresswaysLine 1 and other tourist scenic roads and transportation integration facilities have been upgraded and improved"fast forward"Slow Travel"Transportation network. Enhance the radiation capacity of Hefei’s comprehensive transportation hub, implement projects such as airport reconstruction and expansion, rail transit, and expressways, and promote combined transportation of air, land, and air and rail. Support rural revitalization and development, promote transportation construction projects to be more tilted towards entering villages and households, and promote the connection of buses to public transportation in established villages. Promote the application of smart transportation technology, deepen the research on technologies such as the intelligence of survey and design, and the maintenance and testing of underwater buildings, and promote the pilot construction of new infrastructure.

Three isImprove the security mechanism for the construction of a province with strong transportation. Improve the internal and external operation working mechanism for the construction of a province with strong transportation, give full play to the functions of the office of the leading group for the construction of a province with strong transportation, establish normal working mechanisms such as coordination and linkage, dispatch guidance, monitoring and evaluation, and press stubble to promote implementation. Issue a three-year action plan and annual work points for the construction of a province with strong transportation. Scientifically formulate supporting policies, and prioritize plans and funds for projects included in the scope of pilot construction.Actively promote the promotion and application of pilot experience results, and promote the transformation of pioneering into demonstration and leadership.

(2) Take the initiative to serve and support major national strategies

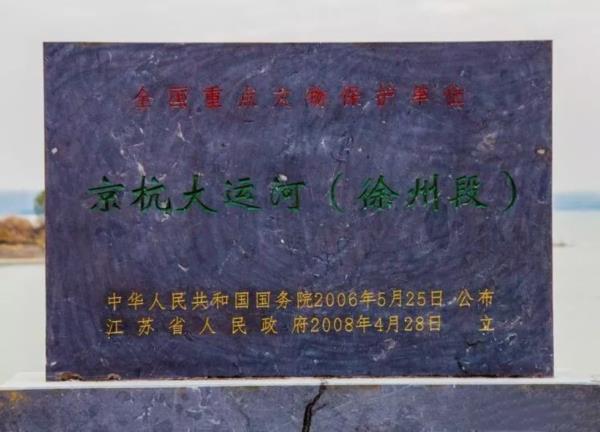

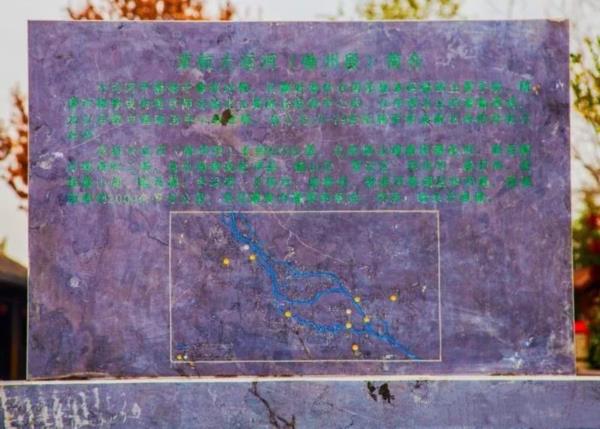

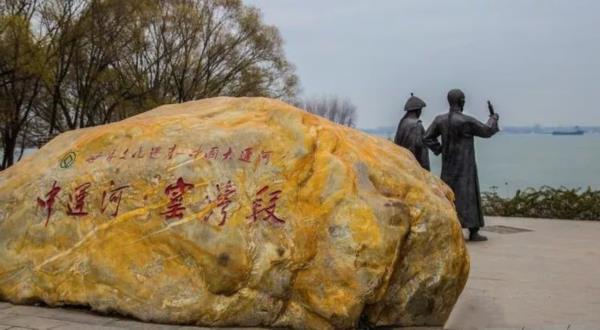

The first is to promote the higher-quality integrated development of the Yangtze River Delta. Strengthen project cohesion and work together to formulate a comprehensive three-dimensional transportation network plan for the Yangtze River Delta region…Do a solid job"Six counties in one place"The transportation work of the Yangtze River Delta Ecological Priority Green Development Industrial Centralized Cooperation Zone will be launched first, and the renovation and expansion of Xuanguang Expressway and provincial highways will be launched firstA number of projects such as the reconstruction of 459 Guang’an Road. Serve northern Anhui to undertake the development of industrial transfer agglomeration areas, give priority to supporting major transportation channel projects in agglomeration areas, start construction of expressways such as Suzhou to Guzhen, and implement trunk highway projects such as National Highway 237, Anhui-Jiangsu Provincial Boundary to Dangshan, and Provincial Highway 101 Huaixu Express Channel. Continue to promote regional interconnection, speed up the implementation of projects such as Huangqian Expressway, coordinate the opening up of inter-provincial road sections such as Ningxuan-Hangzhou Expressway, and smooth the new Bianhe waterway, Wushen Canal and other inter-provincial waterways. Support the provincial port and shipping group to deepen the integration of ports and shipping resources, and promote the strategic coordination, market integration and dislocation development of ports along the river and along the Huai River and coastal ports. Deepen the strategic cooperation between the provincial"Integration"Freight"single system"Traffic"One Card"And information services"one-stop shop"…

The second is to assist in the construction of the beautiful Yangtze River (Anhui) economic belt.Solidly implement the national and provincial ecological environment warning film on transportation problems, and continue to advance"23 + 80 + N"Problem rectification. Built WuhuLNG refueling station, effectively operate Anqing tank washing station, and promote the construction experience of ship sewage landing projects in the Xin’an River Basin. Continue to promote the transformation of port shore power facilities and ship power facilities, and improve the matching degree between port shore power facilities and ship power facilities.Strictly crack down on ships’ failure to use shore power in accordance with regulations.Promote the full coverage of the joint supervision and service information system for marine water pollutants, and strengthen the supervision of the use of pollution prevention and control facilities in ships and ports.Strengthen the linkage of pollution prevention and control law enforcement between ships and ports, continue to carry out special projects such as inland waterway ships involving sea transportation, and improve ship pollutants"ship– Port – City"Collaborative management effectiveness. Advance"three no"Ship regulation, cooperate with the ban on fishing in key waters of the Yangtze River Basin.

Three isContinue to promote the effective connection between comprehensive poverty reduction and rural revitalization.On the basis of completing the task of poverty reduction in transportation as scheduled,high-quality propulsion"Sihao Rural Road"Construct, effectively serve and support the implementation of the rural revitalization strategy. Maintain the stability of the transportation poverty reduction policy, continue to promote the widening and reconstruction project of the narrow road base pavement of rural highways, and upgrade and transform county and township highways500 kilometers, 500 kilometers of double-car roads in organized villages were implemented, and 2,000 kilometers of hardened roads in large natural villages with more than 20 households were built. Deepen the reform of the rural highway management and maintenance system, carry out 6 provincial reform pilots, and guide and promote the start of pilots at the municipal and county levels; give full play to the assessment"Baton"The role is to promote the implementation of the responsibilities of road chiefs at the county, township and village levels, strengthen the construction of professional management teams, and promote the proportion of large and medium repairs of rural highways to reach5%, excellent medium road rate not less than 85%. Create 8 provincial"Sihao Rural Road"Demonstration counties, promoting the establishment of national and provincial demonstration cities and demonstration counties. Strictly implement"Four don’t pick"Required to continue to deepen the fixed-point assistance work.

(3) Highlight project challenges,Improve and upgrade the transportation infrastructure network

The first is to strengthen the planning of major projects.around"Anhui on the highway"Anhui on the Waterway"Anhui on the wings"Closely combined with the needs of local economic development, relying on the preparation of major development plans at all levels, overall planning of major highway, waterway, and civil aviation projects, focusing on comprehensive transportation planning, focusing on the connection with land and spatial planning, and accelerating the formation of plans"Fourteenth Five-Year Plan"And the medium and long-term transportation infrastructure project library, establish a batch of reserves, start a batch, build a batch, and complete a batch of echelon promotion mechanisms, forming a virtuous circle of continuous and rolling implementation.

The second is to strengthen the pre-work. Implement the pre-work of the expressway to focus on key actions and take superConventional combat mode, comprehensive inversion of the construction period, strict wall chart operations, and efforts to promote the start of construction of Wuxuan Expressway reconstruction and expansion, Taihu Lake to Qichun Expressway, etc19 1355-kilometer expressways, rolling to promote the preliminary work of 7 projects planned to start in 2022, including the Anqing Haikou Yangtze River Highway Bridge. Implement the pre-work of ordinary national and provincial trunk highways to focus on key operations and deepen"Provincial-municipal joint construction"Key support and key dispatch of highway connectivity projects from provincial capitals to cities, cities to counties, and intercity bottleneck road sections.Accelerate the advancement of national highways312 Quanjiao Section, National Highway 329 Hanshan Section and other first-class highway projects.Coordinate and promote the preliminary work of key water transportation and civil aviation projects, and start construction of water transportation projects such as the renovation of the Bengbu section of the Tuolu River waterway, the second phase of Dingbu Port in Langxi County, and the bulk cargo terminal in Suixi CountyHefei Xinqiao Airport Phase II, Bozhou Airport2 civilian airports, as well as Feixi Guanting, Tongcheng, etc5A general airport.

The third is to speed up the construction of key projects. Continue to do a good job in building and stabilizing investment, and ask the provincial government to issue implementation opinions on accelerating the development of water transportation in our province, and build a policy support system for the construction of three major sector projects of highway, water transportation and civil aviation. Make every effort to promote20 nearly 1,300 kilometers of expressways under construction have been completed, including the Gubang Expressway, Wuhuang Expressway, and Chizhou-Shitai section of Chiqi Expressway.fully realized"County Expressway"Develop and implement expressways"county seat pass"Advance the plan. StrongDispatch and advance of under-construction projects of trunk highways in ordinary countries and provincesConstruction of 3,000 kilometers of ordinary national and provincial trunk roads, more than 100 kilometers of new highway connectivity projects from provincial capitals to cities, cities to counties. Implementation of 6 new foreign-funded projects including the reconstruction project of the G328 Dingyuan to Yongkang section. Speed up the construction of key water transportation projects,Implemented a pilot program for comprehensive management of vortex waterways and port construction.buildInvoke the Jiangji-Huai Shipping Project, the main water transportation channel of the Huaihe River, and the renovation projects of tributary waterways such as the Tuoshou River, complete the renovation of the waterway of the Shuiyang River, and build the Genglou double-track ship lock of the Shaying River. Speed upThe reconstruction and expansion of Fuyang, Chizhou and Anqing transportation airports has been completedHefei Xinqiao Airport apron expansion and Lujiang general airport new.

The fourth is to focus on strengthening the engineering organization.Actively respond to the globalization of project distribution. The challenges of diversification of investment subjects and centralization of project implementation. Rationally arrange the construction sequence of expressways and national and provincial trunk highways, scientifically formulate special project plans such as quality control, safety assurance, traffic organization, and construction organization, and create a smooth, safe, green, and efficient construction environment. Highlight precise management, effectively divert traffic in advance, reduce the number of traffic guidance changes, rationally determine vehicle speed limits, and avoid long-distance detours or congestion. Strengthen project quality supervision, compact the main responsibility of quality management, make full use of digital and information technology, promote management mode transformation and management capacity enhancement, and build a safe century-old quality project.

(IV) Promote deep integration and optimize the supply of integrated transportation services

The first is to optimize and promote the construction of comprehensive transportation hubs.Construction of airport hub and completion of Hefei Xinqiao Airport"One hub, one center"Programming,Promote SF Express Anhui Regional Air Transit Center,Wuhu (JD.com) global air cargo super hub port construction and operation. Construction of port hub, start the first phase of Wanhe New Port project, etc5 port terminal projects,Continue to promote the first phase of Wuhu Port Zhujiaqiao Port Area12 projects were implemented to accelerate the construction of Wuhu Ma’anshan Jianghai Intermodal Transport Hub and Hefei Jianghuai Intermodal Transport Hub; improve the hub collection and distribution system, and build 2Along the river,4 container and transportation highway projects along Huai, further open up"First kilometer"and"The Last Mile". Build a dry port hub, start construction of the transportation hub center of the high-speed rail new area in Susong County, and build a new Anqing West11 passenger transportation hubs and 5 freight hubs including Wuhu Baote Railway Logistics Comprehensive Base.

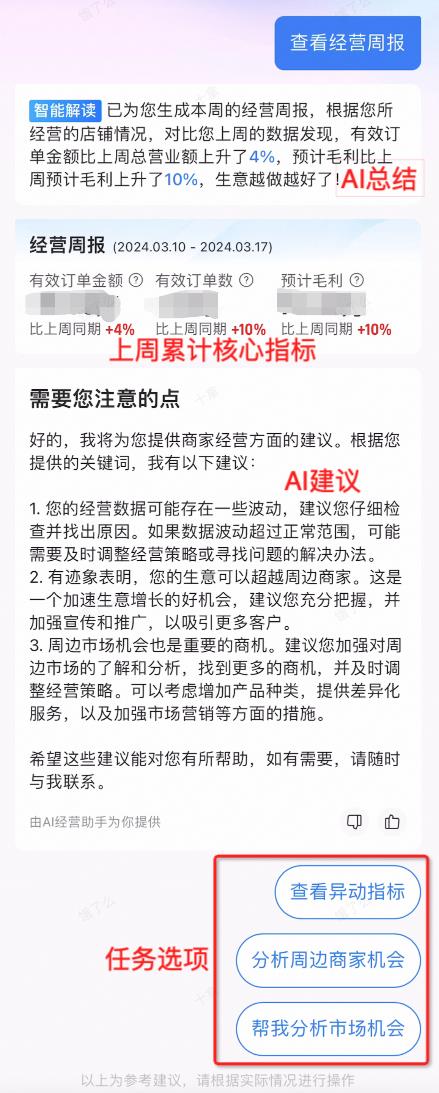

The second is to promote the intensive and efficient development of freight services.Vigorously develop inland river container transportation and consolidate expansion"One core and two wings"Container routes. Advancing bulk cargo"Gongzhan iron"Circular water", strive"molten iron"Container intermodal traffic growthMore than 10%. Complete the first batch"10 + 2"Acceptance of multimodal transport demonstration projects, and establishment of the second batch of demonstration projects. Vigorously develop air cargo, and strive to open Japan, South Korea, and Hefei– Beijing and other all-freighter routes, promote the establishment of local airlines, and expand the regular truck flight business between Hefei and Shanghai Airports. Strictly implement"green channel"TruckETC 15% off and other toll reduction policies. 100 township transportation stations with more than three functions have been newly built or renovated. The coverage rate of express delivery services in established villages has reached 85%. Speed up the construction of provincial network freight information monitoring systems, encourage the development of network freight platforms, and carry out network freight monitoring and evaluation.

The third is to accelerate the improvement of passenger service quality.Prioritize the development of public transportation and promote4 national public transportation cities and 11 priority public transportation demonstration cities were established, and the operation evaluation of Hefei Rail Line 4, the northern section of Line 5 and Wuhu Light Rail was done well. Encourage and guide the transformation of public transportation enterprises, support the development of customized passenger transportation, and continue to promote the transformation of road passenger transportation to urban and rural public transportation integration;Speed up the transformation of public transportation in towns and villages, and the proportion of public transportation in established villages will reach40% to promote the development of global public transportation.Launch the establishment of urban and rural transportation integration demonstration counties.Increase the application and promotion of new models and new products such as commuter shuttles and shared cars, and guide the promotion of enjoyment in the Hefei metropolitan area1-Hour commuter passenger service. Increase ETC issuance, vigorously promote ETC multi-scenario applications, and add more than 1 million ETC users.

(5) Focusing on deepening reform and accelerating the improvement of the industry’s modern governance capabilities

The first is to continue to deepen reform in key areas. Fully complete the formation of comprehensive law enforcement teams in cities and counties, and rationally divide the boundaries of law enforcement responsibilities.Establish and improve the comprehensive law enforcement operation mechanismPromote the implementation of the reform of the division of fiscal powers and expenditure responsibilities in the field of transportation, formulate a list of the division of fiscal powers and expenditure responsibilities in the field of water transportation management and maintenance; deepen the reform of the investment and financing system, and support transportation investment and financing enterprises to raise funds through distribution company bonds, medium-term notes, perpetual bonds and other channels; actively plan foreign-funded projects and strive for more foreign-funded loans. Actively strive for the amount of special project bonds for toll roads, and make full use of live special project funds, special project bonds and new financing tools. Make every effort to strive for the pilot reform of low-altitude airspace management. Improve the freight rate formation mechanism for cruise taxis, and encourage cities with conditions to actively explore the implementation of government-guided prices for cruise taxis.

The second is to promote the construction of government departments under the rule of law in depth. Issue implementation opinions on deepening the construction of government departments under the rule of law in transportation. Make overall plans for local legislative planning in the industry and speed up the legislative process of the "Anhui Provincial Waterway Regulations". Fully implement the three-year action to improve the quality of law enforcement personnel and continue to advance"Four basics and four modernizations"Construction, comprehensive promotion and application of the Ministry and the province to jointly build a comprehensive administrative law enforcement management information system (Phase II). Compile and implement administrative inspection lists and comprehensive administrative law enforcement lists. Do a good job"eighty-five"Popularization of lawWe shall earnestly strengthen the publicity and education of the Constitution, the Civil Code, and industry laws and regulations.

The third is to continue to optimize the business environment of the industry. Distribute a class of seafarers’ certificates of competence, special training certificates, etc4 provincial matters, adjusted"Ship welder examination qualification determination"For public service matters. Promote the decentralization of a number of high-frequency and convenient power matters that are conducive to grassroots undertaking and industry supervision, and strengthen interim and ex post supervision. In-depthimplement"Four get one service free" Double Thousand ProjectdeployDeepen the application of transportation electronic licenses and fully implement government services"Good bad review"System, actively promote government services"Inter-provincial general office"Consolidate"Credit Ministry of Transport"Create results and improve the construction of integrity system. Strictly standardize bidding supervision and maintain market order in transportation construction. promote application"Double random, one public"Internet+ supervision"and"Credit supervision", standardize the development of new business models. Actively participate in the construction of free trade zones in our province.

(6) Coordinate the development of safety and strictly prevent safety risks in the transportation industry

oneIt is necessary to do a good job in epidemic prevention and control. Improve the command and dispatch, emergency plan, and material security system of epidemic prevention and control, and formulate a winter and spring transportation classification and classification epidemic prevention and control work planEstablish and improve the emergency reporting system for major incidents, strengthen training and drills, and ensure timely and efficient emergency response.insist"person"thing"environment"With the same defense, strictly implement the prevention and control measures stipulated in the road and waterway epidemic prevention and control guidelines. Implement measures such as ventilation and disinfection of transportation tools and stations, passenger temperature measurement, and health code inspection. Strengthen the control of cold chain transportation and import high-risk non-cold chain transportation links, and establish cold chain transportation enterprises, vehicles, and personnel ledgers. Do a good job in the transportation of emergency materials. Strengthen entry personnel"Point-to-point, one-stop shop"Take delivery, do a good job in international ship docking operations and crew shifts. Make every effort to ensure the Spring Festival transportation service under the normalization of epidemic prevention and control.Continue to do a good job in regular prevention and control work such as contacting insurance, government agencies and schools.

twoIt is necessary to firmly maintain the bottom line of safe production.Strengthen the responsibility of transportation safety production, improve step by step after the reform of the safety committee under the overall guidance of the management industry must manage the new pattern of work safety"Concentrated year"Activities, continue to promote the task of rectification, focusing on the road transportation of hazardous chemicals, inland waterway ships involving sea transportation, ferry ferry and other safety centralized rectification, continue to carry out the special project action of adhering to the quality and safety red line of highway and waterway projects. Accelerate the construction of transportation safety supervision and emergency command information system, establish major risks and hidden dangers in the industry, key supervision objects"Electronic map"Organize and implement the census of natural disaster comprehensive risk highways and waterways, form a dual prevention system of risk prevention and control and hidden danger management, and resolutely curb the occurrence of major safety accidents.

The third is to consolidate and deepen the achievements of overloading and overloading governance"Fourteenth Five-Year Plan"Planning of super-site. Actively promote the off-site law enforcement pilot experience of Huaibei, Chuzhou, Tongling and other super-sites. Complete the construction of a networked super-site management information platform jointly built by the ministry and the province, accelerate the upgrade and transformation of super-site facilities and equipment, promote the networking sharing of site detection data and video information, and achieve the networking rate of super-site in the provinceMore than 90%. Dynamically adjust the province’s key supply supervision units, speed up the construction of the electronic capture system of fixed super stations, and promote the full coverage of electronic capture at fixed super stations. Improve the integrated law enforcement cooperation mechanism of the Yangtze River Delta, and carry out joint inter-provincial and inter-municipal regional super control actions such as three provinces and one city in the Yangtze River Delta and six Tongyi four cities on a regular basis.

Fourth, make every effort to maintain the stability of the industry. Actively preventvariousRisk, do a good job in ensuring the payment of migrant workers’ wages. Normally promote the fight against gangs and evil special projects to"9 ? 28"The accident and the passenger market chaos prompted by the provincial procuratorate’s procuratorial proposal should be the focus, and the transportation market chaos should be comprehensively cleared and the chaos management in key areas should be deepened.Ensure the safety and stability of the domestic and international logistics supply chain.Improve the transportation system for emergency materials"1 + 9"Emergency plan system, conduct exercises and drills on a regular basis. Consolidate and improve working mechanisms such as forecasting and early warning, risk research and judgment, and make every effort to do a good job in safety supervision and emergency protection during key periods such as extreme weather, major events, and holidays and flood seasons. To celebrate the founding of the PartyThe 100th anniversary will create a safe, stable and harmonious atmosphere.

Highlight technological innovation and deeply empower the development of smart green transportation

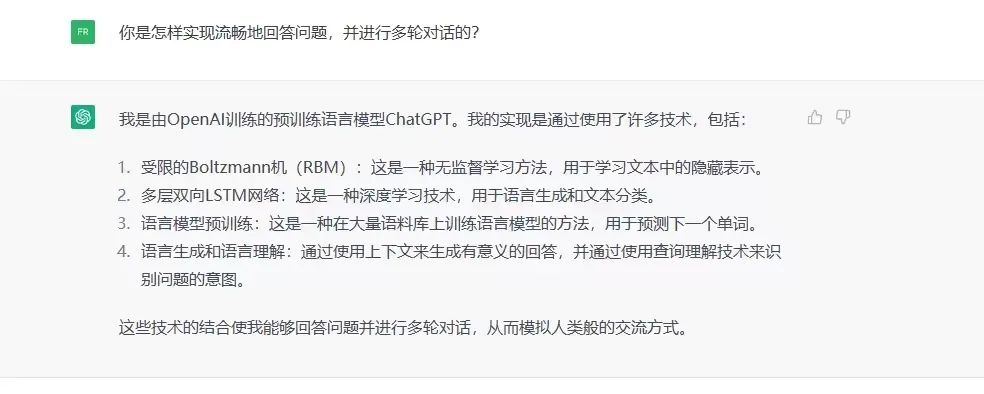

One is to promote the digital transformation of transportation.Complete the preparation of the "Overall Framework Design of Intelligent Transportation in Anhui Province", formulate standards and specifications for the exchange and sharing of transportation information resources, and launch a three-year action plan for smart transportation construction. Launch the pilot projects of Haining and Ningwu Smart Expressway and Wuhu Port Smart Port.Deepen the application research of new technologies such as big data and artificial intelligence in the field of comprehensive law enforcement supervision of road transportation,Support the development of autonomous driving demonstration applications.Construction of comprehensive traffic operation monitoring and coordination of command, networking, etc6 provincial government affairs information platforms, planning to promote the construction of 14 provincial government affairs information projects such as smart transportation big data centers, and accelerate the digitalization process of industry governance. Do a good job in information cyber security.

The second is to enhance the ability of transportation science and technology innovation. Support transportation leaders to form systematized and task-oriented innovation teams, and promote transportation intelligent manufacturing R & D centers, etc6 ministries and provinces to build science and technology innovation platforms, strengthen key core technology research, and promote"Highway Industrialization Intelligent Construction Technology Science and Technology Demonstration Project"Research on key scientific and technological projects to accelerate the industrialization of scientific and technological achievements. Strengthen the formulation of standards in key areas such as Yangtze River Delta regional standards and infrastructure, green environmental protection, and smart transportation.

The third is to promote green and low-carbon development of transportation. Actively implement the national transport action plan for peak carbon dioxide emissions. Strengthen the strict control and efficient use of space resources in transportation infrastructure, implement green design, green construction, and green operation, and promote the intensive conservation and utilization of resources in the field of transportation and ecological protection. Strengthen the promotion and application of new energy and clean energy vehicles, ships, etc., and the proportion of new energy buses in the new and replacement buses will reachMore than 80%. Strictly control the access of operating vehicles, and promote the pollution control of operating diesel trucks. Carry out green travel creation actions. Do a good job of dust control on highways and waterways. Strictly crack down on illegal cross-border transfer and dumping of solid waste and hazardous waste.

(8) Adhere to the strict word first and continue to purify the good political ecology of the industry

First, always put political construction first. Persistently learn to understand and implement the Supreme Leader’s thought on socialism with Chinese characteristics for a new era, in-depth study and implementation of the spirit of the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China and the instructions of the General Secretary of the Supreme Leader’s important speech on Anhui, strengthen"Four Consciousness"Firm"Four self-confidence"achieve"Two maintenance"Take not forgetting the original intention and keeping in mind the mission as the eternal task of strengthening the party’s construction and the lifelong task of all party members and cadresFurther promote the model organbuild,Continue to strengthen the construction of basic skills at the grassroots level.Solid development"Double contention and one creation" action,"pilot"Plan to enhance the vitality of grass-roots organizations and truly build grass-roots party organizations into a strong fighting fortress to promote the development of transportation.

The second is to comprehensively promote positive style and discipline"Live a tight life"Demand, practice economy and oppose waste. insist on correcting"Four Winds"Together with the new wind, persevere in implementing the spirit of the eight central regulations, and resolutely prevent the outstanding problems of rectifying formalism and bureaucracy. Implement the main responsibility of comprehensively and strictly governing the party, always put discipline and rules in front, and accurately use supervision and discipline"Four forms"Strengthen communication and coordination with the discipline inspection and supervision team in the office to accelerate the construction of"three no"Long-term mechanism. Adhere to no-restricted areas, full coverage, zero tolerance, continue to carry out political inspections, continuously strengthen audit supervision and rectification, investigate and deal with violations of discipline and laws together, persevere and unswervingly, to ensure political clarity and clean teams.

The third is to effectively strengthen the construction of the cadre and talent team. Continuously optimize the structure of the cadre team, coordinate the construction of the cadre echelon well, solidly promote the parallelism of job ranks, improve the assessment and evaluation mechanism, and encourage party members and cadres to perform their duties and responsibilities. Innovate the methods of cadre education, training and practical exercise, and carry out cadre training and education at multiple levels and in multiple forms through organizing transfer, off-the-job training, online training, transportation lectures, etc., to comprehensively improve party members and cadres"Seven abilities"Promote the construction of the new campus of Anhui Transportation Vocational TechAcademy, strengthen the training of professional and technical personnel, and do a good job in the evaluation of professional titles. Continue to do a good job in the work of retired cadres, and strengthen the improvement of group groups, united front, war readiness, foreign affairs, petitions and other work.

The fourth is to further enhance the soft power of the industry. Strictly implement the ideological work responsibility system, strengthen the construction and management of positions, and strengthen the monitoring and guidance of public opinion. Strengthen the construction and application of transportation finance media, and organize the development"Looking at Anhui along the expressway"And other theme publicity activities to tell the traffic story of the new era. Solidly do a good job in party building100th Anniversary Series Celebrations. Deepen"Smile service, warm transportation"Cultural brand effect, promoting volunteer service branding, cultivating advanced models in the industry, giving play to the role of advanced models in demonstration and encouragement, continuously boosting the energy of the organs and establishing a good image of transportation.