Dry goods! Analysis of industrial chain status and market competition pattern of video surveillance equipment industry in China in 2021; Hikvision’s output is far ahead.

Major listed companies in the video surveillance equipment industry:At present, there are mainly listed companies in the domestic video surveillance equipment industry (002415); (002236); (002214); (300449); (300150); Dongfang Netpower (300367); (300155); (002835); (300101)。

Core data of this article:China video surveillance equipment industrial chain, China video surveillance equipment panorama, China video surveillance equipment industrial chain enterprise output.

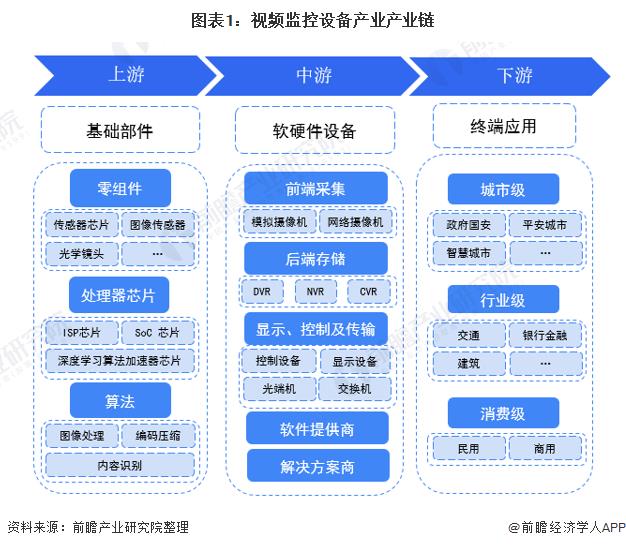

1. Panoramic combing of the industrial chain of video surveillance equipment industry: video surveillance equipment is recycled into an important link.

The upstream of the industrial chain of video surveillance equipment includes components, algorithms and processor chips, among which components mainly include sensor chips, optical lenses and memories. The algorithm mainly includes image processing, video compression and content recognition. The processor chip mainly includes ISP chip in analog camera, SoC chip in network camera, SoC chip in DVR/NVR and deep learning algorithm accelerator chip.

Midstream equipment products mainly include front-end cameras (divided into analog cameras and network cameras), back-end storage and video recording equipment (divided into DVR, NVR, CVR, etc.), control and display equipment at the central control end (including display screen, server and control keyboard, etc.) and optical terminals and switches in each transmission link. In addition, there are system management software based on hardware products.

The downstream products have a wide range of terminal applications, which can be divided into city-level, industry-level and consumer-level end-user applications.

At present, in the field of upstream components of video surveillance equipment, the main representative companies are Hehe, Huawei Hisilicon and ZTE Microelectronics in the field of processor chips, and contempt technology and Shangtang technology in the field of algorithms. In the middle reaches of video surveillance equipment, Hikvision and Dahua Co., Ltd. have layouts in front-end, back-end, control terminal and other hardware fields, software and integration. There are many industries and enterprises involved in the downstream of the video surveillance equipment industry chain, and the representative enterprises are,, and so on.

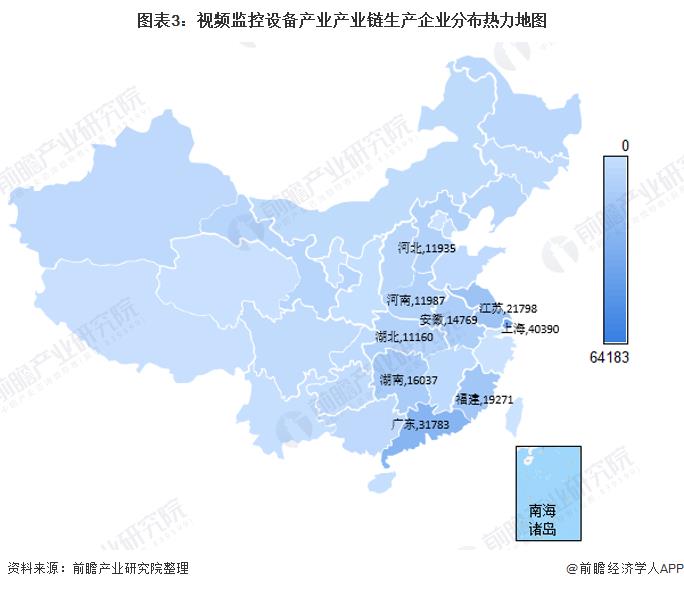

2. The regional thermal map of China video surveillance equipment industry chain: Shanghai is the most concentrated.

Due to the low technical content and low entry threshold of low-end video surveillance equipment, there are many video surveillance enterprises in China, but the scale is generally small. According to the data of Qicha Cat, China’s video surveillance equipment related enterprises are mainly distributed in Shanghai, Guangdong, Jiangsu, Fujian and other regions, with the distribution characteristics of "western light and eastern heavy". Among them, Shanghai has the most concentrated distribution of related enterprises. As of August 2021, Shanghai has more than 40,000 enterprises, followed by Guangdong with more than 30,000 related enterprises.

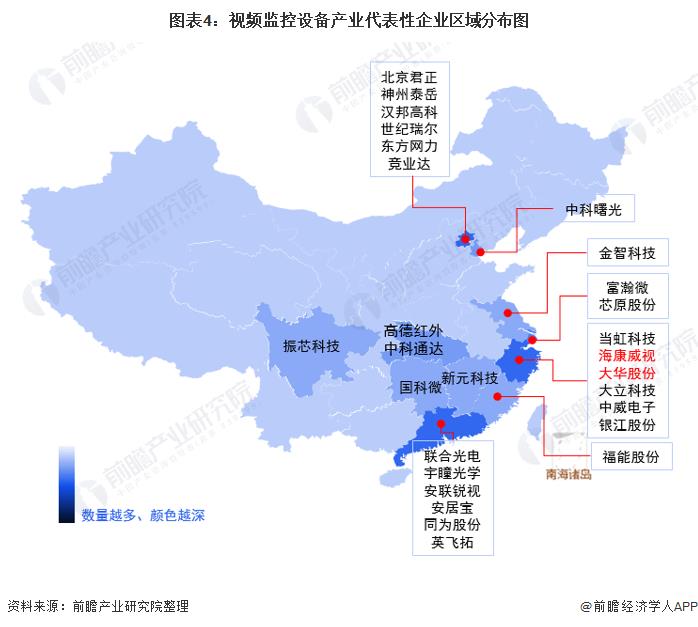

From the distribution of representative enterprises, there are many representative enterprises in Beijing, Shanghai, Guangdong and Zhejiang, among which Hikvision and Dahua, the leading video surveillance enterprises in China, are located in Zhejiang.

3. Capacity/output of representative enterprises in China video surveillance equipment industry: Hikvision’s output is far ahead of other enterprises.

At present, among the listed companies with chips related to frequency monitoring equipment, the output of integrated circuit series products is more than that of other companies, and the output of Hikvision is far ahead of other companies in video monitoring listed companies. The capacity/output of other representative enterprises in the industrial chain of video surveillance equipment industry is as follows:

Note: The enterprises in the statistics are listed companies that have published relevant capacity/output data, and listed companies that have not published specific capacity/output data are not included in the statistics.

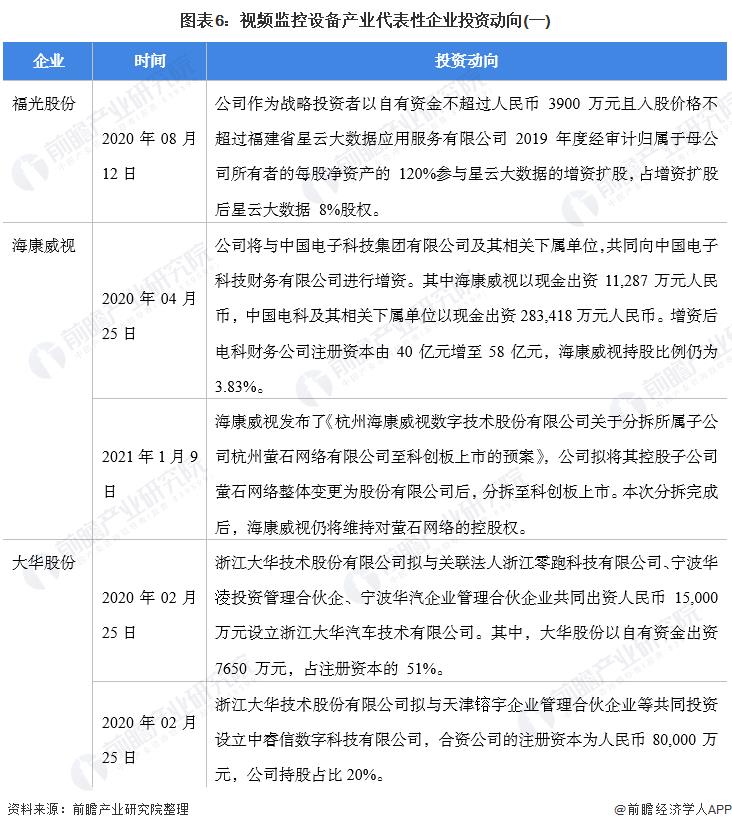

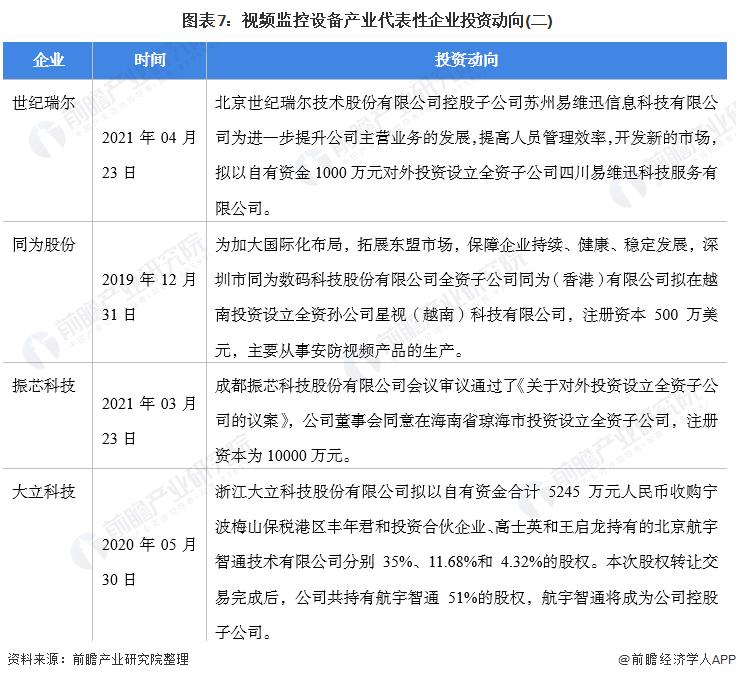

4. Latest investment trends of representative enterprises in China video surveillance equipment industry.

Since 2020, the investment trends of representative enterprises in the video surveillance equipment industry mainly include acquiring companies to expand their business and investing in video surveillance equipment production base projects by increasing capital of subsidiaries. The latest investment trends of representative enterprises in the video surveillance equipment industry are as follows:

Please refer to Foresight Industry Research Institute for the above data and analysis. At the same time, Foresight Industry Research Institute also provides solutions such as industrial big data, industrial research, industrial chain consultation, industrial map, industrial planning, park planning, industrial investment attraction, IPO fundraising feasibility study, IPO business and technology writing, and IPO working paper consultation.